CashPro: Enhancing Financial Management with Digital Innovation

- 1 Key Specifications Of CashPro

- 1.1 Comprehensive Capabilities Driving Adoption

- 1.2 Mobile Access: Enabling Continuity and Flexibility

- 1.3 Prioritizing Security through Ongoing Assessments

- 1.4 Analytics and Reporting Tools for Informed Decisions

- 1.5 Redefining Payment Management

- 1.6 CashPro’s Global Reach

- 1.7 The Pillars of CashPro’s Digital Innovation

- 1.8 Safety

- 1.9 Envisioning the Potential of CashPro

- 1.10 Insight for Strategic Advantage

- 1.11 Seamless Processes

- 1.12 Empowering Clients through Continued Innovation

- 2 Pros and Cons of CashPro

- 3 Conclusion

- 4 FAQs

In Short:

- The Bank of America CashPro platform is a digital banking solution to the banking needs of 40,000 business and commercial clients worldwide, which made 340 million transactions in 2023.

- CashPro Insights, as an additional feature, makes the platform more powerful, offering data-based intelligence for treasury decision-making, among others, such as industry benchmarks and alerts about deposit balances.

- The mobile app was awarded as the best Corporate Digital Banking and turned out to be an invaluable tool during the pandemic by allowing clients to perform transactions from home without risks to safety, thus showing the bank’s interest in customer satisfaction.

- CashPro services are composed of tight security services, smoother payments and reporting tools, and even cash management solutions that can be connected to the SCF services of CashPro Trade.

Bank of America’s CashPro platform has been transforming treasury management for over 40,000 corporate and commercial clients globally. As a pioneering leader in digital banking solutions, CashPro facilitates efficiency, security, decision-driving analytics, and convenience through continuous innovation. This article explores the platform’s capabilities across key areas.

Key Specifications Of CashPro

| Feature | Details |

| Total Client Payments (2023) | 340 million transactions |

| Security Feature | CashPro Click to Action commands, biometrics, one-time passwords (OTP) |

| Integration Services | CashPro Receivables, Merchant Services, CashPro Trade SCF (Supply Chain Finance) |

| Reporting Tools | Industry benchmarks, graphical representations, dynamic reports |

| Accessibility | Available in over 35 countries globally |

| Language Support | Multilingual – supports nine different languages |

| Security Certifications | Compliance with industry-standard security certifications (e.g., ISO 27001) |

| User Training Resources | Comprehensive online guides, tutorials, and customer support |

| Scalability | Scales to accommodate the needs of both small businesses and large corporations |

| Real-time Notifications | Alerts for critical events, such as balance thresholds and SCF events |

| Device Compatibility | Compatible with a wide range of devices, including smartphones and tablets |

| Customer Support | 24/7 customer support via phone, email, and online chat |

| Fee Structure | Transparent fee structure outlined in terms and conditions |

| Continuous Updates | Regular updates for enhanced features and security patches |

Comprehensive Capabilities Driving Adoption

Handling 340 million client payments in 2023, CashPro serves as a one-stop portal for managing treasury, trade, and credit operations. Its intuitive and user-friendly interface enables self-service functionality for financial transactions. CashPro’s comprehensive feature set and reliability explain its widespread adoption.

Mobile Access: Enabling Continuity and Flexibility

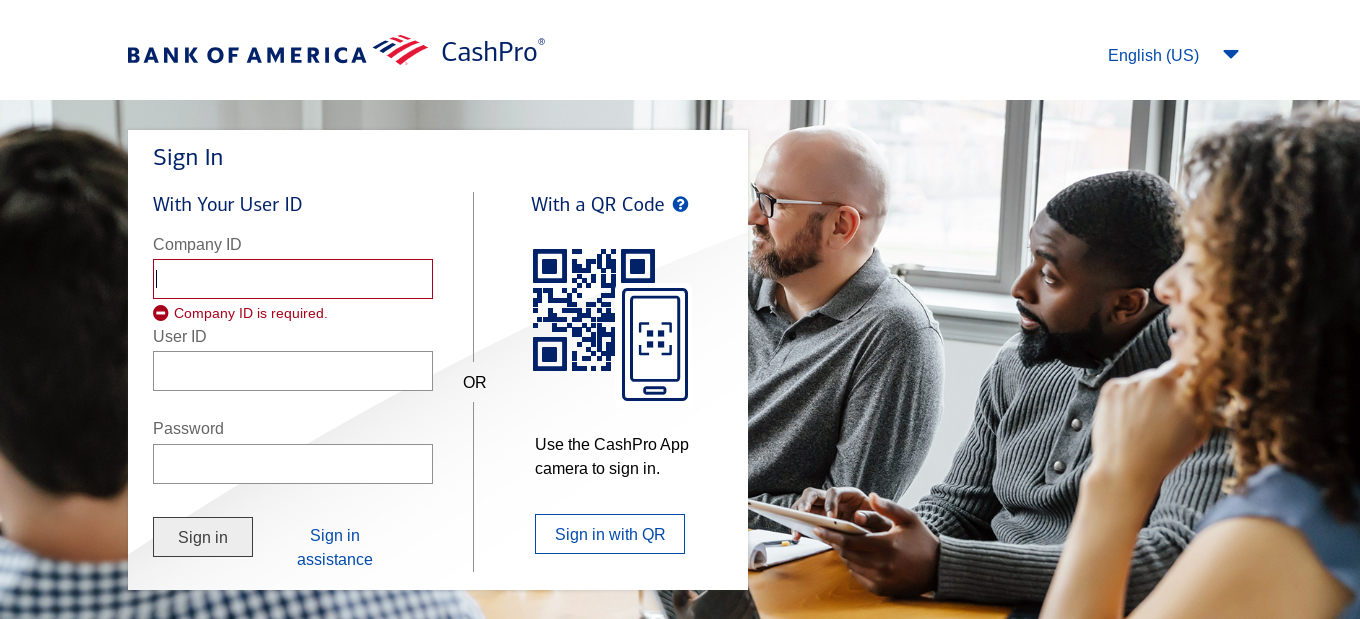

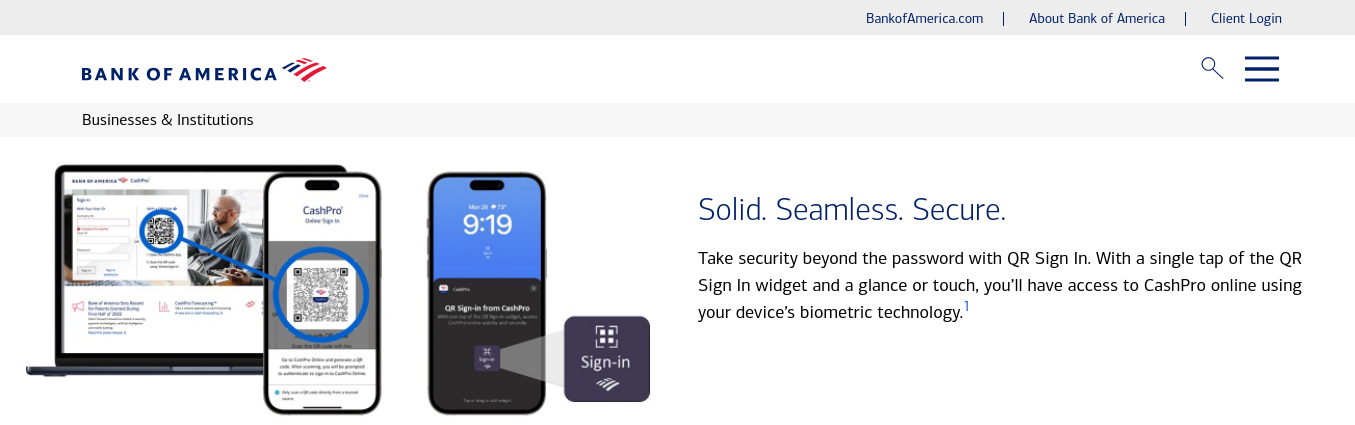

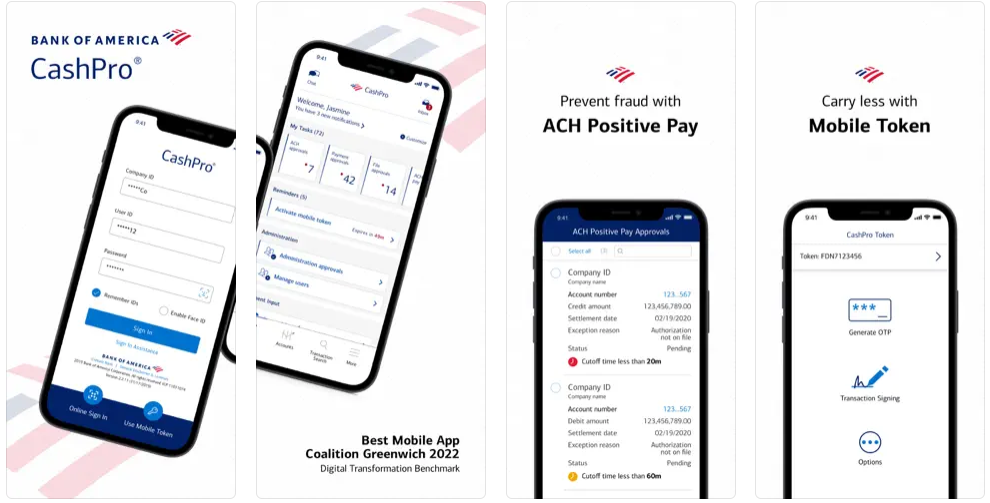

The CashPro mobile app brings unparalleled convenience, allowing users to conduct daily banking remotely. Its significance was highlighted during COVID-19 as users depended on the app for business continuity from home. Accelerated development catering to evolving needs has resulted in unmatched mobile corporate banking capabilities. With biometrics, one-time passwords, and remote functionalities, CashPro mobile empowers flexibility.

Prioritizing Security through Ongoing Assessments

As a banking platform handling sensitive financial data, security is an uncompromisable aspect of CashPro. The recently introduced CashPro Insights feature includes Security Insights that assess and recommend enhancements to a user’s security controls. The seamless implementation of these measures ensures clients can carry out transactions safely. Security is an ongoing process, and CashPro’s proactive stance sets it apart.

Analytics and Reporting Tools for Informed Decisions

Data-driven insights are integral to CashPro’s offerings through CashPro Insights. Features like industry benchmarks, graphical representations, measurements of working capital, payment efficiency, and fraud analytics empower informed decisions. The reporting and analytics capabilities help visualize operations and respond swiftly to opportunities or risks.

Redefining Payment Management

CashPro facilitates optimized, efficient payment management across borders and currencies through integrated data analysis. Features like balance threshold alerts and assessments of payment flows, timing, and supplier relationships enable process improvements. Smooth integrations allow CashPro’s payment capabilities to error-free handle invoices, credit memos, and clarification requests.

CashPro’s Global Reach

- As of 2024, CashPro provides digital banking services to over 40,000 corporate and commercial clients globally, demonstrating the platform’s versatile applicability across diverse geographic regions and sectors.

- The multi-lingual interface, available in nine languages, enables accessibility across global operations. Paired with an extensive network of banking centers, CashPro facilitates optimized implementation of a uniform set of financial processes across subsidiaries.

- Compliance with local regulations is ensured through proper licensing, while value-enhancing tools boost growth in international markets. Clients benefit through real-time monitoring of global cash flows from a centralized dashboard.

The Pillars of CashPro’s Digital Innovation

CashPro’s success lies in the pillars of safety, efficiency, informed strategies, and seamless processes manifesting in every feature. We explore how these pillars enable the platform’s digital innovation.

Safety

CashPro employs defense-in-depth safety across devices, user authentication, and financial transactions via multi-layered protocols. Biometric logins, one-time passwords, immediate notifications on suspicious activities, and AI-based fraud checks secure user accounts and actions. The security insights tool perpetually evaluates and recommends enhancements, making CashPro proactive against evolving cyber threats.

Envisioning the Potential of CashPro

- With continuous experimentation with emerging technologies like AI, ML, and advanced analytics, CashPro is gearing to expand its capabilities dramatically to serve as an intelligent companion to CFOs and treasurers.

- CashPro can take over routine analytical and reconciliatory responsibilities, alerting the leadership on deviations while freeing up strategic bandwidth.

- The transactional and industrial data CashPro holds can be leveraged to train decision support algorithms guiding enhanced capital deployment, precise market entry, and optimized supplier ecosystem creation for clients.

- Stakeholder interactions can be automated via smart conversational agents on CashPro. As 5G and quantum computing unfold, the processing power at CashPro’s disposal sets the stage for paradigm shifts in treasury management.

Insight for Strategic Advantage

The analytical capabilities turn raw data into insights that reveal trends, opportunities, and benchmarks for strategy formulation. As CashPro handles a tremendous volume of financial transactions, the patterns and correlations it uncovers from the collective data offer invaluable business and efficiency insights. Leaders can align operational decisions with industry best practices based on data intelligence from the platform.

Seamless Processes

CashPro interlinks systems, enabling seamless movement of data, approvals, and payments across treasury management workflows. Smooth integration with procurement, billing, and compliance systems establishes synchronized workflows. CashPro’s open architecture allows configurability to accommodate a company’s existing processes for transparency across systems. The results are accelerated payments, efficient budget utilization, and rapid settlements empowering business growth.

Empowering Clients through Continued Innovation

CashPro’s commitment to innovation is reflected in its year-round development pipeline, where client feedback fuels new capabilities. The 2023 introduction of features spanning security checks, payment analytics, and integrations exemplifies this culture of progressive enhancement. Clients thus find sustained value as CashPro elevates their treasury management function to the digital era. The consistency of the new feature rollout has earned CashPro the top spot among corporate banking platforms. Its digital tools empower clients to transform legacy treasury processes and unlock working capital while bolstering security, liquidity, and controls. The visionary outlook of Bank of America manifests in CashPro’s solutions, enabling stakeholders to confidently pursue emerging opportunities and prepare for unseen risks.

Pros and Cons of CashPro

| Pros | Cons |

| Robust security measures | Potential learning curve for new users |

| User-friendly interface | Mobile functionality may vary |

| Comprehensive reporting and analytics | |

| Seamless payment streamlining |

Note: Users need to be aware of potential variations in CashPro functionality between the desktop and mobile apps and the fact that there may be a learning curve for inexperienced users. It is thus advised to review the terms and fees and pay attention to any revisions. Please contact Bank of America’s 24/7 customer service with any queries.

Conclusion

As evident, CashPro goes beyond automation to enact data-driven digitization of treasury management via continuous innovations in user experience, security, analytics, and seamless processing. The feature depth empowers diverse banking and financial activities reliably across devices. With proactive threat and opportunity identification, CashPro enables corporate clients to pursue aggressive growth trajectories through resilient and futuristic treasury infrastructure.

FAQs

Is CashPro accessible to small companies?

Although its main clientele is corporate and commercial, CashPro may be able to help small companies with certain banking needs.

How does security get improved with CashPro Insights?

The security meter function in CashPro Insights evaluates user security controls and recommends enhancing them.

What distinguishes the CashPro mobile app from others?

With its advanced features and intuitive interface, the CashPro mobile app is an addition to the extensive CashPro web platform.

Is there an extra cost to use CashPro Insights?

The terms and conditions that Bank of America provides usually contain information on fees and pricing for CashPro Insights. For further details, it is best to speak with a Bank of America representative.