East Idaho Credit Union Explores New Frontier With Rebrand

- 1 Key Specifications

- 1.1 Humble Beginnings

- 1.2 Core Offerings and Member Benefits

- 1.3 Reaching a Global Membership

- 1.4 Continued Growth Leads to Rebrand

- 1.5 Honoring Heritage and Welcoming New Horizons

- 1.6 Technology Upgrades Streamline Lending

- 1.7 Ongoing Commitment to Quality

- 1.8 The Next Horizon

- 2 Pros and Cons

- 3 Conclusion

- 4 FAQs

- 4.1 How can I join Frontier Credit Union as a member?

- 4.2 What kinds of services is Frontier Credit Union providing?

- 4.3 What led to the rebranding of East Idaho Credit Union to Frontier Credit Union?

- 4.4 What effects has technology had on Frontier Credit Union’s lending procedures?

- 4.5 Does Charity Navigator have a rating for Frontier Credit Union?

In Short:

- The East Idaho Credit Union has laid out the new name and brand of Frontier Credit Union after a massive restructuring plan.

- The credit union’s roots in Idaho are the very thing that makes the name Frontier so unique. It is a homage to the spirit of the West and those who ventured there in search of new lands.

- It is a rebranding that goes hand in hand with the Frontier Credit Union’s growth, which can be seen clearly in the increasing number of branches in Idaho and in the statistics showing that it has the fastest growing rate in the state.

- Frontier Credit Union’s new marking displays the institution’s commitment to inclusivity, a key feature of its identity, with the vision of having a membership base that is representative of its diverse population of over 34,000 people worldwide.

East Idaho Credit Union has a new name, Frontier Credit Union. It is a part of the intentional process that defines the start of a new era in the credit union’s history. The credit union’s development and commitment to delivering the services they require to a vast and ever-growing community are demonstrated by the decision to change the name. Credit unions have had an extended past that goes back to 1935. The name “Frontier” is a nod to the spirit of independence and the historical exploration of the American West and is part of the Idaho roots of this institute.

The credit union has been making a rebranding effort at the same time as its unprecedented expansion, which has been demonstrated through the addition of other branches in Idaho and the fact that it is the fastest-growing credit union in the state. Therefore, this tactical change will see Frontier Credit Union as an active partner contributing to the members’ growth and mission to financial success.

Key Specifications

| Attribute | Details |

| Name | Frontier Credit Union |

| Formerly Known As | East Idaho Credit Union |

| Membership | Over 34,000 members, reaching globally |

| Services | Loans, investment, savings, credit/debit cards |

| Technology Partner | IMM |

| Branches | 11 branches |

| Website | www.eastidahocu.org |

| Contact | 208-523-9068 |

Humble Beginnings

East Idaho Credit Union’s journey began in 1935 when a group of Idaho Falls government employees established Idaho Falls U.S. Government Employees Federal Credit Union to serve the financial needs of their peers. In 1963, the credit union expanded its membership to include multiple employee groups and adopted the name East Idaho Federal Credit Union. Another name change came in 1998 when the institution took on the East Idaho Credit Union moniker.

Over nearly nine decades, East Idaho Credit Union has provided stable and reliable service to generations of members. Its longevity is a testament to the trust placed in it by members and the continuity provided by its dedicated staff, many of whom have been with the institution for over 20 years.

Core Offerings and Member Benefits

As a full-service financial institution, East Idaho Credit Union has continually added products and services to support the economic success of its members. It provides an array of savings and lending solutions, including.

- Savings Accounts

- Free Checking Accounts

- Certificates of Deposit

- IRAs

- Credit Cards

- Auto, Mortgage, Home Equity, and Personal Loans

- Home Banking and Bill Pay

- Mobile Banking Apps

The credit union prides itself on meeting diverse financial needs while providing personalized service in branches and through digital channels. East Idaho Credit Union’s longevity and stability give members confidence that it will maintain solid fiscal stewardship while understanding and catering to their unique requirements.

Reaching a Global Membership

Headquartered in Idaho Falls, Idaho, East Idaho Credit Union has grown beyond serving local government employees. Its community charter and occupation-based expanded charter allow it to serve members across Idaho, the nation, and internationally. With over 34,000 current members, East Idaho Credit Union has account holders residing as far away as Malaysia.

Yet even while expanding its reach, East Idaho Credit Union remains committed to offering individualized financial solutions. The credit union works diligently to accelerate lending processes while minimizing errors that could delay loan approvals or funding. Its adoption of eSignature technologies by partner IMM allows East Idaho Credit Union to facilitate loans securely in remote scenarios.

Continued Growth Leads to Rebrand

Over the past decade, rapid expansion in membership and locations has inspired East Idaho Credit Union’s board of directors to evaluate its existing brand. While the previous name reflected East Idaho Credit Union’s legacy beginnings, it no longer encapsulated its statewide presence and global member base.

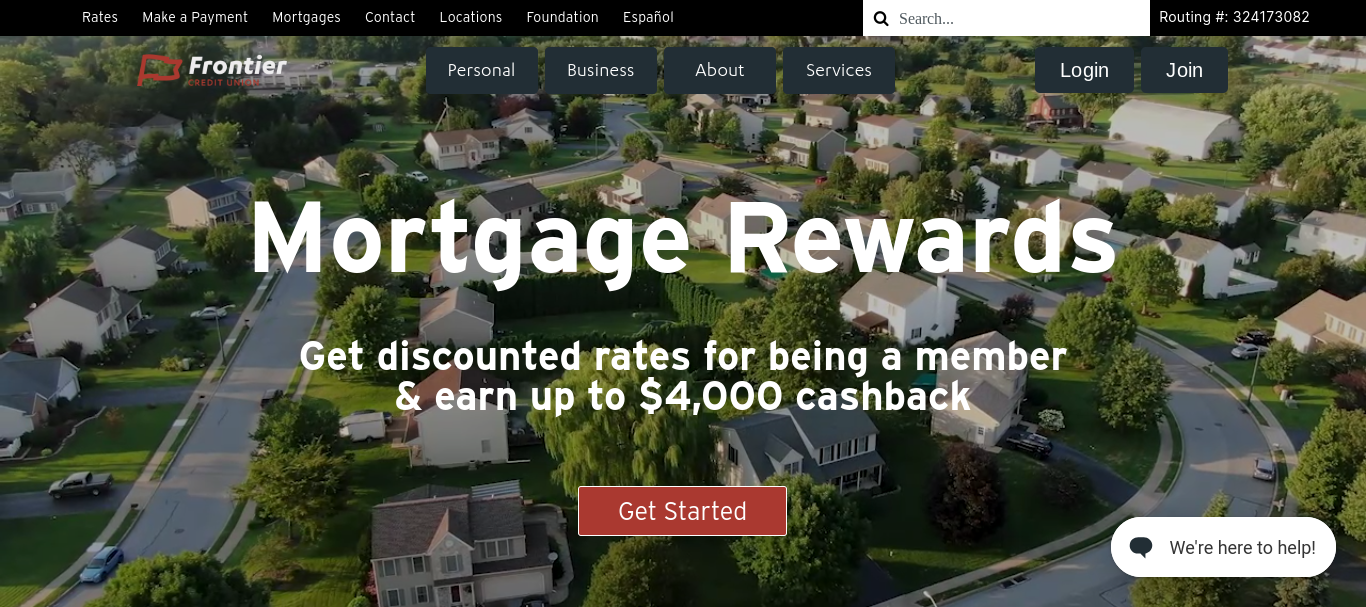

Additionally, the phrase “East Idaho” implied the credit union only served a particular geographic segment of Idaho. In actuality, the institution has members across the entire state. After careful evaluation, the board determined a new brand name could welcome potential members who mistakenly assumed East Idaho Credit Union did not represent their interests. Thus, in 2023, after yearlong strategizing, East Idaho Credit Union unveiled its rebrand as Frontier Credit Union.

Honoring Heritage and Welcoming New Horizons

Frontier Credit Union pays homage to Idaho’s storied history of intrepid exploration while celebrating present-day conquests into uncharted fiscal territory. Its connotations with adventure, risk-taking, independence, and resilience reflect the attitudes of the credit union as it continues aggressive, yet prudent, growth.

Along with the new name, Frontier Credit Union introduced corresponding branding, including

- A flag logo denoting ambitious progress

- An updated colour scheme of Dark Denim, Americana, and Beacon, which connect visual branding to Frontier Credit Union’s mission and values

Frontier Credit Union signals welcome to all existing, former, and prospective members with its inclusive branding and versatile offerings. The newly minted name represents the institution’s commitment to collaboration, discovery, and trailblazing new milestones hand-in-hand with the communities it serves.

Technology Upgrades Streamline Lending

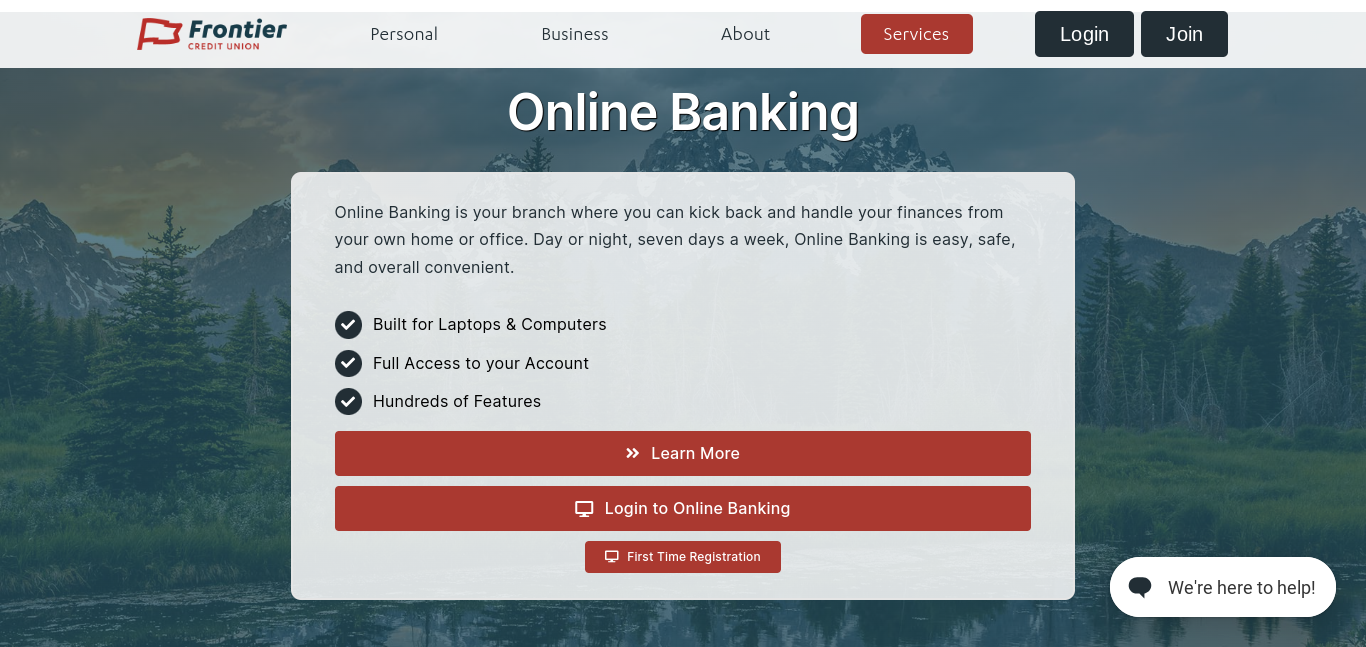

Frontier Credit Union utilizes cutting-edge fintech to accelerate services and simplify processes. Recently, it collaborated with lending solutions provider IMM to institute document presentation and eSignature capacities for front-end and back-end lending transactions. Members can digitally complete and sign applications, closing documents, and disbursal forms rather than handle paper files.

The partnerships with IMM have tangibly bettered Frontier Credit Union’s agility by

- Reducing total loan processing time

- Empowering near real-time approvals

- Lessening the likelihood of errors that delay funding

- Enabling digital archiving for loan documents

Likewise, IMM software training helps Frontier Credit Union personnel optimize and take ownership of enhancing systems. Staff members gain knowledge to construct intelligent documents tailored to the credit union’s offerings and member requirements.

Ongoing Commitment to Quality

Current advancements do not signify the completion of enhancements at Frontier Credit Union. The institution interprets its new name as a pledge to forge further inroads that surpass expectations.

Frontier Credit Union continues increasing competency in:

- Expanding community outreach

- Creating cutting-edge digital experiences

- Reworking internal frameworks to amplify access to services

- Adding channels such as video chat lending officers and self-service kiosks

- Implementing emerging technologies like digital wallets and cryptocurrency exchanges

Its budget of more than $650 million will fund ongoing transformation into a world-class credit union. With its dedicated employee base, Frontier Credit Union seems destined for new milestones in assisting members’ fiscal ventures.

The Next Horizon

Frontier Credit Union stands well-positioned to turn continued growth into positive community impact. Its rebranding ushers in an era highlighting elevated expectations — one where chasing new horizons leads to more Idahoans achieving economic mobility and independence. With its rich history and recent influx of new visions and technology, Frontier Credit Union has hit its stride.

Pros and Cons

| Pros | Cons |

| Diverse financial solutions | Lack of available economic data for evaluation |

| Efficient lending processes | Limited information on leadership and adaptability |

| Inclusive rebranding as Frontier Credit Union | Unavailability of historical ratings |

| Longevity and stability of staff | |

| Community involvement and growth | |

| Embracing technology for member convenience |

Note: The institution, formerly East Idaho Credit Union, recently announced its rebranding as Frontier Credit Union. While the credit union has fully adopted its new name and branding, readers may still encounter references to its old name on properties like its website domain and social media handles until tech migrations are finalized. Rest assured, East Idaho Credit Union and Frontier Credit Union refer to the same trusted financial entity.

Conclusion

As Frontier Credit Union forges new paths to unconquered lands, it advances ever onwards, driven by ambition yet directing its steps by ethics. Members have found in the bank both financial insight and a servant’s heart for the community that has been there for nearly eighty years. Frontier Credit Union is sights on granting more people and families opportunities to actualize their desires. With the brand name changed and the credit union’s image updated, the core mission of serving Idahoans and expanding its global membership in financial prosperity is still at the heart of the credit union. The Frontier Credit Union is prepared to extend assistance to both existing and potential members to help them find ways to a brighter future. By holding to its fundamentals and incorporating contemporary techniques, Frontier Credit Union’s future is bright and promising.

FAQs

How can I join Frontier Credit Union as a member?

To become a member of Frontier Credit Union, call them at 208-523-9068 or go to their official website, www.eastidahocu.org. The credit union offers a community charter as well as an enlarged charter based on employment, so it accepts people from a variety of backgrounds.

What kinds of services is Frontier Credit Union providing?

A variety of financial services are offered by Frontier Credit Union, such as credit/debit cards, loans, investment options, and savings accounts. Features for easier account administration are also available to members through Internet banking.

What led to the rebranding of East Idaho Credit Union to Frontier Credit Union?

The credit union’s dedication to expansion and diversity is reflected in the renaming as Frontier Credit Union. Given the credit union’s Idaho origins, the name “Frontier” honors the hardy independence and exploratory legacy of the American West.

What effects has technology had on Frontier Credit Union’s lending procedures?

At Frontier Credit Union, the amount of time spent processing loans has been greatly decreased by implementing IMM’s superior document presentation and eSignature solutions. Loan officers may increase productivity and member satisfaction by preparing the required paperwork in half the time.

Does Charity Navigator have a rating for Frontier Credit Union?

Currently, Charity Navigator has not assigned a rating to Frontier Credit Union. Frontier Credit Union is not included in Charity Navigator’s evaluation of NGOs that are registered as 501(c)(3) organizations since it is a financial institution.