How is a Digital eKYC Solution Better than Traditional KYC?

- 1 Empower your Account Opening Process through Aadhaar eKYC Services in India

- 2 What is the Digital eKYC Solution in India?

- 2.1 Typical e-KYC Online Process Solution

- 2.1.1 Phase 1: Mobile Number Verification

- 2.1.2 Phase 2: Email Verification

- 2.1.3 Phase 3: PAN Verification

- 2.1.4 Phase 4: Select Segment and Brokerage

- 2.1.5 Phase 5: UID Or Aadhaar Verification with the Power of Digital Locker

- 2.1.6 Phase 6: Provide Personal Details

- 2.1.7 Phase7: Share your Bank Details

- 2.1.8 Phase 8: Upload your Documents

- 2.1.9 Phase 9: In-person Verification

- 2.1.10 Phase 10: Perform Digital Signature

- 3 Advantages of using E KYC Online Service

- 4 Economical Digital KYC Solution

- 5 Reduces Overall Time for EKYC

- 6 Fulfil the Requirement for Regulatory Compliance

- 7 Bottom Line

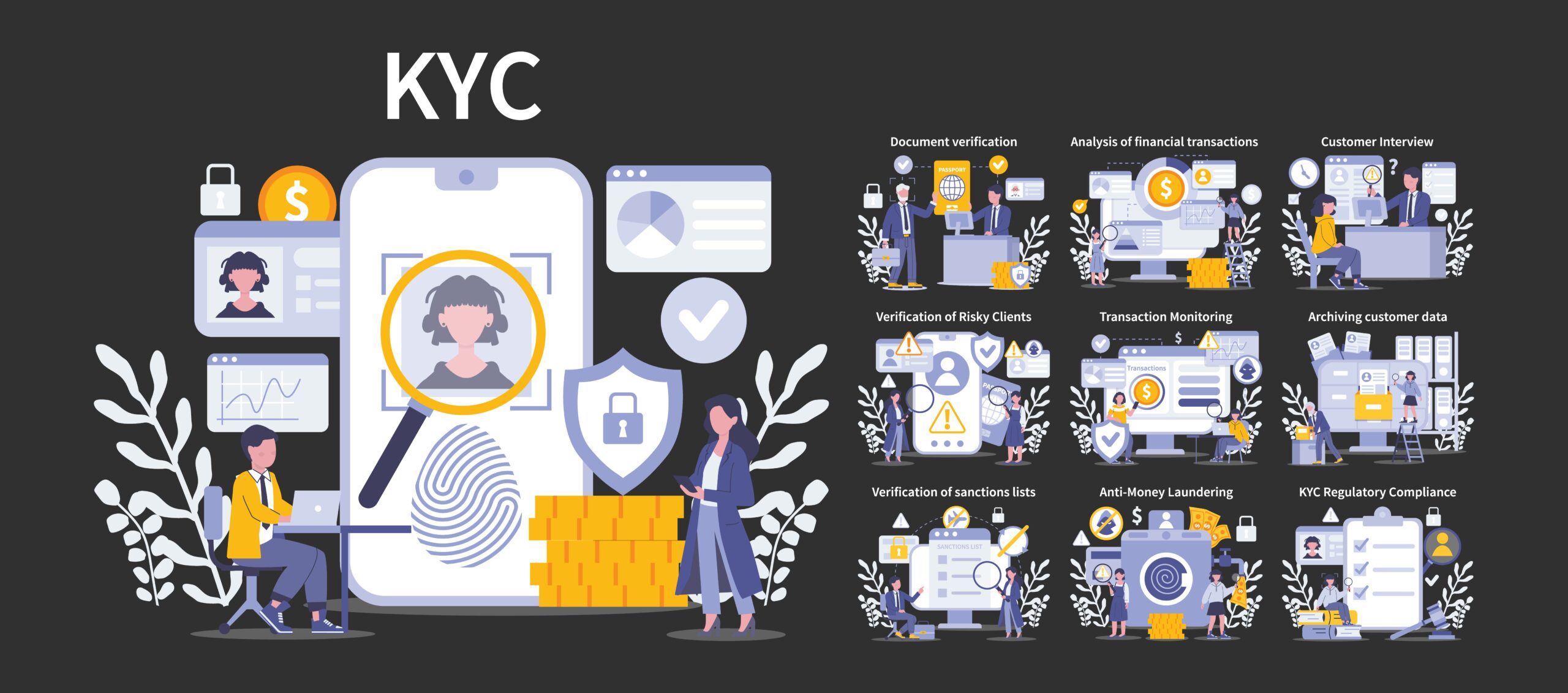

eKYC ( electronic Know Your Customer) is a perfect replacement for the manual Know Your Customer process that allows you to submit physical documents. Digital eKYC solution is an advanced version that addresses the issues associated with traditional KYC. It includes collecting the documents, inputting the essential details, document checks and validation, turnaround time for completing the process, and security issues.

Empower your Account Opening Process through Aadhaar eKYC Services in India

During the traditional KYC process, the users need to be physically present and provide the physical documents related to their address proof, government-issued identity papers, and other essential documents. If the user misses any document, it may create a frustrating situation. On the other hand, Aadhaar eKYC services provide a platform where users do not bring physical papers, and related identity documents will be fetched directly from Digital Locker after the user’s consent is obtained. It eliminates third-party intervention and speeds up the KYC process.

However, the purpose of using the KYC online service is to eliminate the chance of any identity theft, fraud, money laundering, and other illegal activities. The document’s validation process will be done automatically, which will increase privacy overall. The adoption of Digital eKYC Solution is a digital innovation that is reshaping how banks and financial institution services manage their compliance and eliminating the risks associated with money laundering and fraud.

What is the Digital eKYC Solution in India?

The concept of e-KYC online came into existence when users were tackling various issues related to traditional KYC processes. Digital eKYC solutions use automation to collect data, process, and verify customers’ identity information.

In this method, technologies are used to make the account opening procedure more efficient, such as OTP verification through Aadhaar, optical character recognition (OCR), a secure and user-friendly interface, and eliminating in-person verification meetings and submitting physical documents.

Typical e-KYC Online Process Solution

The process of customer identity verification may differ from service to service. But, the primary purpose of implementing it by eKyc service providers is to streamline digital workflow and enhance efficiency and security. Let’s discuss the step-by-step process of e-KYC online such as:

Phase 1: Mobile Number Verification

The user needs to enter the mobile number on an online form provided by the service provider and submit an OTP received at the registered number.

Phase 2: Email Verification

OTP may send a registered email ID and submit it to the given online form.

Phase 3: PAN Verification

Provide your PAN and DOB details for further processing. After submitting all these data, then data will be fetched from NDML.

Phase 4: Select Segment and Brokerage

This section displays various segments for future trade and selects the brokerage plan from broker offers.

Phase 5: UID Or Aadhaar Verification with the Power of Digital Locker

Enter your UID number on the online form for the e-KYC process, and you will receive an OTP at your registered number. All identity-related documents will be fetched directly from DigiLocker for further processing.

Phase 6: Provide Personal Details

This step is related to providing the essential details that are not available in Digital Locker and declaring your nominee also.

Phase7: Share your Bank Details

Provide your bank account details, and verification will proceed through Penny Drop.

Phase 8: Upload your Documents

This step is related to submitting all the documents based on the selection of segments.

Phase 9: In-person Verification

The KYC management software India captures the image and location simultaneously for face recognition.

Phase 10: Perform Digital Signature

After completing all the steps, the user needs to sign all the documents with a single effort.

Advantages of using E KYC Online Service

Reputed eKyc service providers can help you perform paperless KYC that strictly adheres to industry standards and compliance, impacting various facets of a financial institution’s operations.

Economical Digital KYC Solution

Traditional KYC processes may lead to various operations costs, such as physically collecting the documents, multiple manual verifications, document checks, and more. Thanks to eKYC online, which allows you to automate data capture and verification, you can reduce the various overheads on paper handling, storage, and error correction.

Reduces Overall Time for EKYC

One of the main advantages of implementing eKYC management software in India is that it mitigates the turnaround time to onboard new customers. Traditional KYC may take many days, while paperless Know Your Customer can be accomplished in minutes.

Fulfil the Requirement for Regulatory Compliance

Reputed eKYC providers like Meon offer a robust and digital KYC framework that strictly follows the regulations around anti-money laundering( AML) and counter-terrorism financing (CTF). Moreover, eKyc service providers offer a platform to conduct detailed background checks and boost operational efficiency.

Bottom Line

Leveraging eKYC for your business can accelerate the onboarding process for new customers and remove security issues. It is faster, reliable, user friendly and utilises the power of Aadhaar details for verification. When the user’s information matches the UIDAI database, they can undergo further processing.