Ownwell Reviews: Everything To Know

- Ownwell helps you check your evaluation for mistakes and exemptions.

- See if your home is overvalued with a comparative market study.

- Present proof to your county tax assessor to reduce your assessment.

- Appeal to the assessment review board for your county.

- Represent you at tax assessor hearings to reduce your taxes.

- Contact your county assessor or board to reduce your assessment.

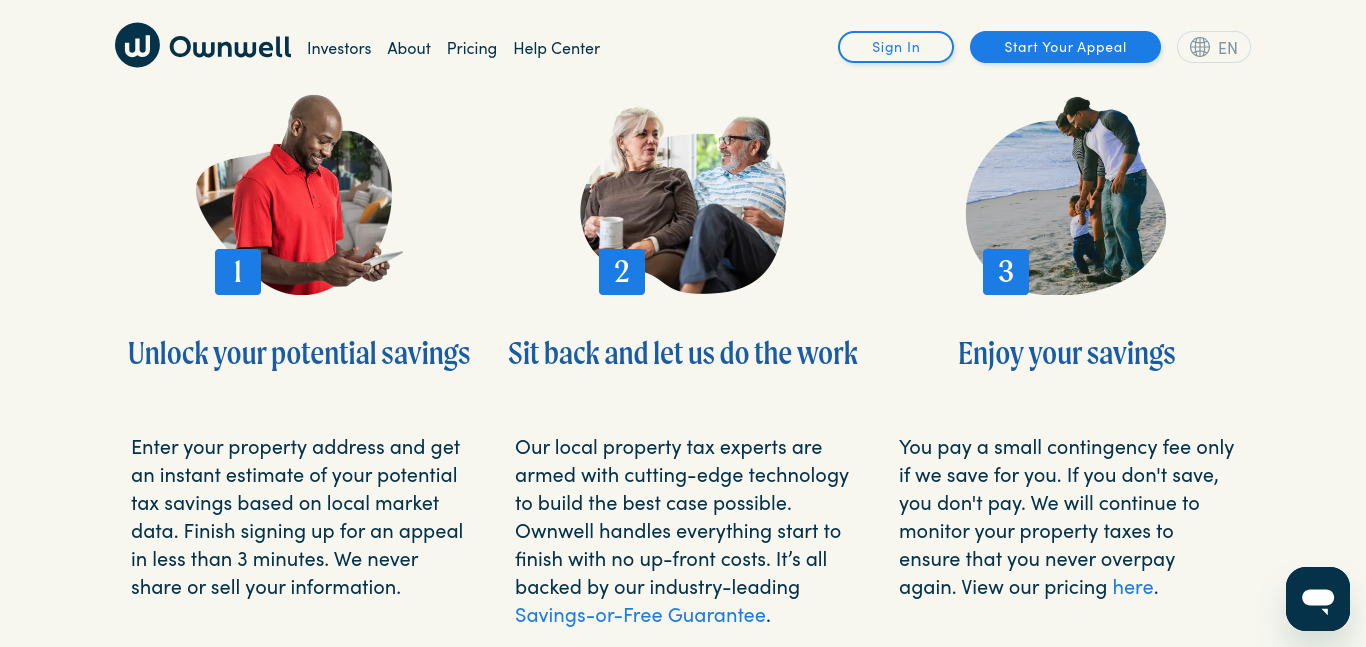

US homeowners may negotiate cheaper property taxes with Ownwell. Ownwell guides homeowners through county property tax appeals with a team of local, skilled negotiators. The platform claims to have saved homeowners thousands on property taxes. The process is straightforward. Users give Ownwell their property’s address and assessed value. Then, an Ownwell Reviews professional will evaluate the situation and look for savings. If savings are possible, they will appeal to the homeowner.

What Does Ownwell Do?

Ownwell Reviews excels in household, small company, and real estate investor property tax reduction. To reduce property taxes, Ownwell will:

- Check your evaluation for mistakes and exemptions.

- See if your home is overvalued with a comparative market study.

- Present proof to your county tax assessor to reduce your assessment.

- Appeal to the assessment review board for your county.

- Represent you at tax assessor hearings to reduce your taxes.

- Contact your county assessor or board to reduce your assessment.

After your assessment appeal, we’ll monitor your property’s future assessments. If your taxes rise or you’re overassessed again, we’ll contact you and file a fresh appeal to lessen your property tax.

Is Ownwell Scam?

No. Company Ownwell is legitimate. Austin-based company has 42 LinkedIn workers. The founder was Colton Pace. My friend John Egan interviewed Colton at InnovationMap. Ownwell is a young, fast-growing firm, but I can verify it. I successfully appealed my property taxes last year. See my screenshots below.

Pros

- Ownwell is easy to manage. Simply provide some simple information online, wait for their answer, and authorize them to begin your appeal. No calls. No debate. No problem.

- The Ownwell works. I saved $233 using Ownwell. Helping over 80% of consumers is their boast.

- Ownwell aids you annually. Ownwell desires lifelong customers and will appeal your property taxes the following year without resubmitting.

Cons

- Ownwell is exclusively offered in seven states, including Texas, California, and New York.

- Company Ownwell is new. Increasing enterprises and entering new states will cause increasing pains.

- Ownwell takes 25% of the funds. DIY property tax appeals let you keep 25% of Ownwell payments.

What Is Ownwell Price?

Ownwell charges 25% of savings. No upfront charge is required. If they cannot save you money (either by deciding an appeal is not worth it or by failing to appeal), they don’t charge you. If they lower your property taxes by $1,000, you would owe Ownwell $250. You would owe Ownwell $250 in the case above.

Ownwell Does What?

Ownwell specializes in household, small company, and real estate investor property tax reduction.

To reduce property taxes, Ownwell will:

- Check your evaluation for mistakes and exemptions.

- See if your home is overvalued with a comparative market study.

- Present proof to your county tax assessor to reduce your assessment.

- Appeal to the assessment review board for your county.

- Represent you at tax assessor hearings to reduce your taxes.

- Contact your county assessor or board to reduce your assessment.

- After your assessment appeal, we’ll monitor your property’s future assessments. If your taxes rise or you’re overassessed again, we’ll contact you and file a fresh appeal to lessen your property tax.

Ownwell Reviews: My Well Experience

Ownwell helped me negotiate/appeal my rental property taxes. Here are my numbers:

The county assessed my property at $402,522. After an appeal, Ownwell determined a revised value of $390,657—a reduction of $11,865. In my county, taxes are 1.9632%. Ownwell cut my property taxes by $233 ($11,865 x 1.9632%). Ownwell invoiced me 25% after notifying me of my savings. My debt was $58.23.

What to Expect From Ownwell?

Ownwell is straightforward. Visit their website and enter your address. They will respond soon if they can assist. Next, you must agree to let them appeal your property tax and pay 25% of the savings. Then you wait. Complete the property survey to boost your appeal prospects. Surveys capture additional information that may aid your case. Ownwell tells you of the County’s decision after its hearing.

Who Needs Ownwell?

Ownwell should be used by homeowners and landlords who don’t wish to challenge property taxes. It’s free to evaluate your property taxes. Thus, trying it is harmless. Your confidence and comprehension of the tax appeal procedure determine whether you negotiate your property taxes alone or with a service. Negotiating your property taxes yourself might save you money on service costs, but it can be intimidating if you’re not familiar.

I’d utilize Ownwell every time since I’ve appealed myself. Using Ownwell to represent you may save you time and stress during the appeals process. Their team of specialists and resources helps maximize your tax reduction chances. However, employing Ownwell does not ensure a successful appeal or property tax decrease. Property tax assessments are complicated, and property valuation, local tax rules, and appeal details can all impact the decision. Whether you negotiate your property taxes yourself or utilize Ownwell should depend on your trust in the appeal procedure and your grasp of the expenses.

The Legality Of Ownwell

- The domain was repaired on January 10, 2013.

- The website is 9 years, 3 months, and 14 days old.

- This webpage expires on January 10, 2023.

- The trust score is 86%.

- Alexa rank: 2,214,172.

- Origin: USA.

- 13/100 for suspicious website proximity.

- Wearing SSL secures data.

- No threat profile

- N/A for phishing.

- N/A for malware.

- N/A for spam.

Note: Ownwell is on Facebook, Instagram, LinkedIn, Twitter, and YouTube. The Ownwell website is legitimate, with five-star and exceptional reviews. Read Ownwell’s Google reviews to learn more about the site.

FAQs

Ownwell’s phone number?

They are in seven states presently. Phone numbers are below:

- Texas (512) 886-2282

- Georgia (678) 890-0767

- Florida (305) 901-2905

- New York (516) 518-3334

- Washington (206) 395-8382

- Illinois (312) 500-3131

- California (310) 421-0191

It takes how long?

The entire procedure takes months. I applied to Ownwell in late April last year. I learned of a successful appeal in September. Ownwell invoiced me on Sept. 15 and gave me a month to pay. Your chronology may vary.

What is the price that you charge?

We don’t charge anything upfront; instead, we only take a contingency fee from you once we reduce your property taxes. Our assistance is completely free even if you don’t save any money.

What is the maximum amount I can save?

Single-family homes that qualify for a decrease usually use our service to save an average of $1,148 annually. Check out how much you may save by using our savings calculator. For a comprehensive examination, real estate investors should get in touch with sales.

How can my taxes be lowered?

We oversee the whole property tax reduction process, from submitting papers to having conversations with county assessors to appearing at appeal board meetings. Our approach involves utilizing both specialized technology and local expertise to create the strongest case possible for property tax reduction.