X1 Credit Card: A Comprehensive Review

- 1 Key Features of X1 Credit Card

- 1.1 Application Process and Eligibility Criteria

- 1.2 Understanding the X1 Rewards Program

- 1.3 Security and Fraud Protection

- 1.4 Potential Drawbacks and Considerations

- 2 X1 Card Exploration: Things To Consider

- 2.1 Income Determines Eligibility:

- 2.2 Immediately Available Rewards:

- 2.3 Instant Card Use After Approval:

- 2.4 Fee-Friendly Method:

- 2.5 Convenient Efficiency Features:

- 3 Pros and Cons

- 4 Conclusion

- 5 FAQs

- With regard to the competitive arena of credit cards, the X1 card is one of a kind since it selects individuals with good earnings but who have an average performance as far as credit scores are concerned.

- The defining property of the X1 Card is its unique approach to credit history evaluation.

- The card does not simply work with credit scores but rather considers current income and future incomings as well, which may lead to a maximum of 5 times higher limit compared to the money spent.

The X1 Card, made of sheer, sleek 17-gram stainless steel, not only weighs less and measures little but is also characterised by a variety of features that make it an interesting card. It meets the needs of target users who want to avoid inconveniences in credit processing in terms of annual and late fees, including foreign transaction fees. Yet the card’s main distinctiveness has to do with its loyal program, which, being as generous as it is, comes with a chicken bone – redeeming rewards cannot be used in more than fifty listed retail partners comprising well-known brands Airbnb, Apple, Lululemon Nike Sephora among others. In this article, let us discuss the features briefly at a glance, the application process, it is a rewards program, security measures it has incorporated, potential benefits-disadvantages analysis, etc.

Key Features of X1 Credit Card

| Feature | Details |

| Welcome Bonus | N/A |

| Annual Fee | None |

| Regular APR | 20.24% – 29.99% Variable |

| Credit Score | Excellent/Good Credit |

| Earnings Structure | – 2 points per dollar on every purchase<br>- 3 points per dollar on the next $7,500 in purchases after spending $1,000 in a calendar month |

| Redemption Options | X1 partners for optimal value, including travel, cash back, and various retail partners |

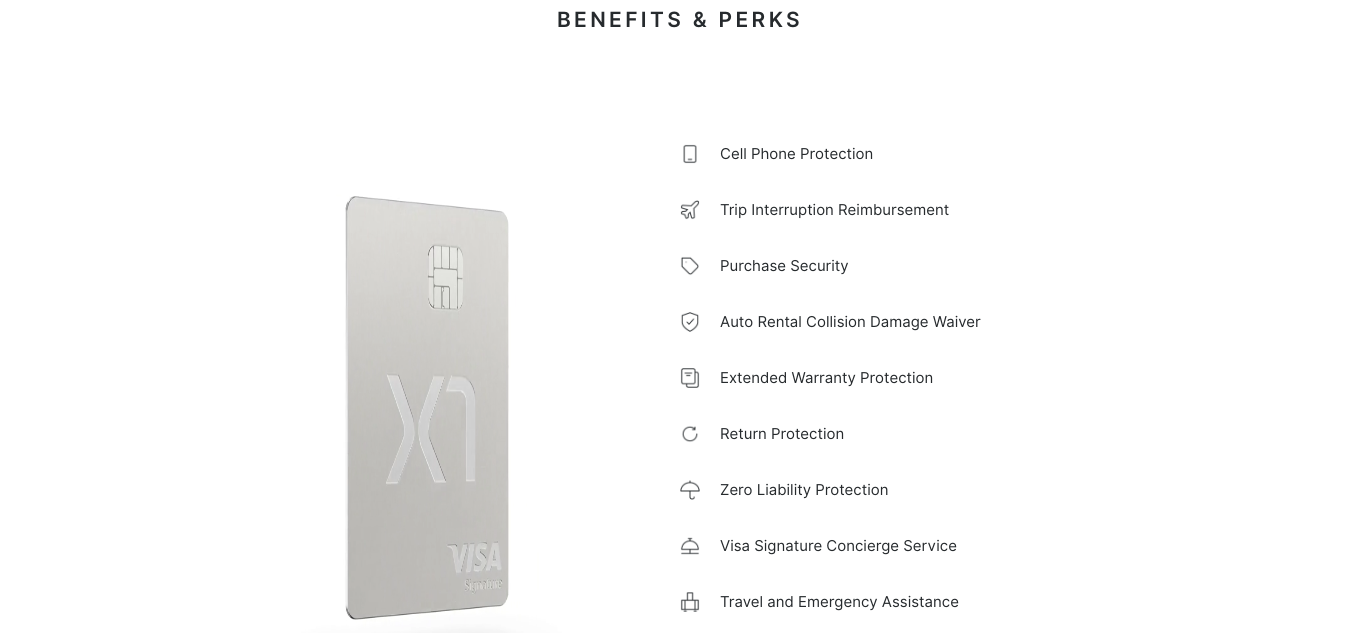

| Additional Benefits | Cell phone protection, trip interruption reimbursement, purchase security, and more |

Application Process and Eligibility Criteria

- A simple process makes the application for the X1 Card. A credit score is not used only to determine eligibility.

- However, a soft pull is made by the card issuer, X1, in terms of your income both now and your possible future earnings mandate underwriting.

- It is interesting to mention that, initially, it’s a soft pull, but on taking the terms and approved inquiry, credit reports are made for an additional account.

- This procedure goes hand in hand with practices of other cards such as the Apple Card and various buy now pay later services.

Understanding the X1 Rewards Program

A generous rewards structure is one of the notable advantages that the X1 Card offers, making it one of the best no-fee credit cards. It is noteworthy that it already gives you 2 points per dollar on every purchase. Still, the card takes it to a higher level, as holding $1,000 for any month in spending and making at least $75 blossoms your life with three points for every dollar within the next seven thousand beyond that of owning one thousand bucks of a sum.

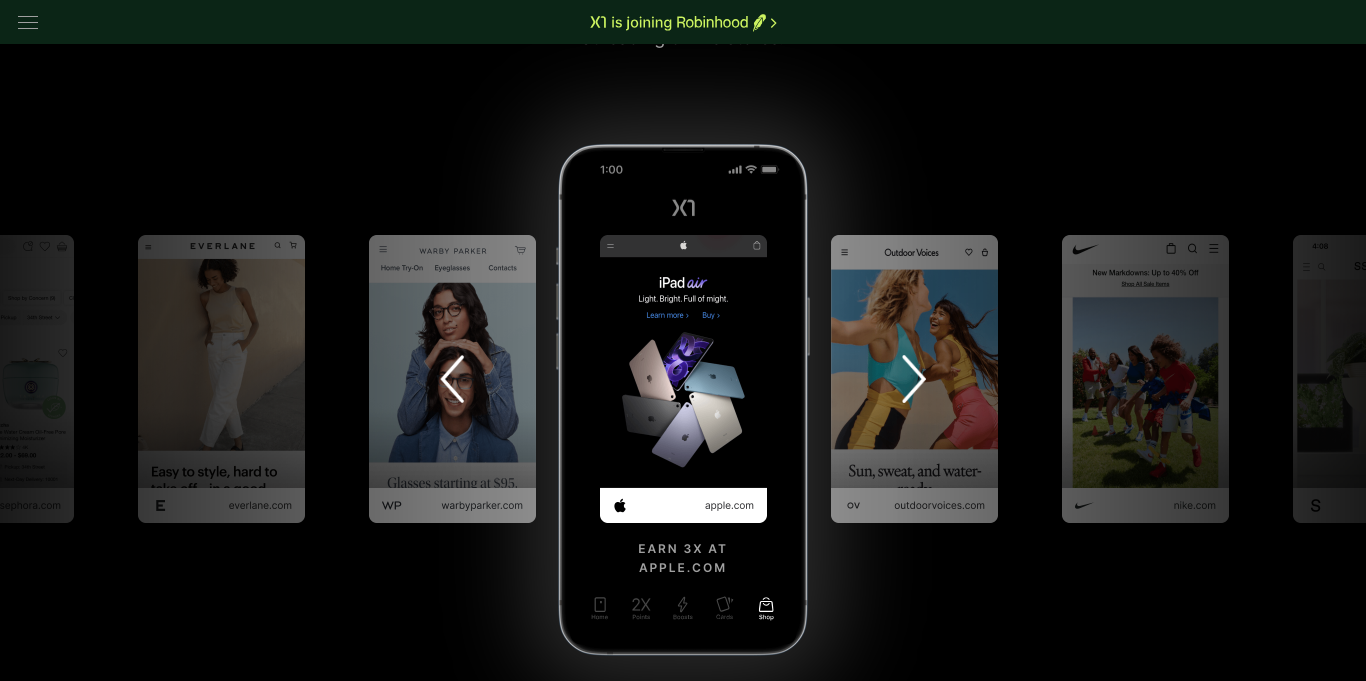

Besides, recommending a friend to the X1 Card can also increase the points, resulting in 4 times earned on every dollar during a month. The liberties, nevertheless, come with one distinct complication – only x1 partners can redeem the benefits. When there are over 50 companies in the retail partnership – namely airlines, Airbnb, and others, along with various retailers, cardholders get the best value by redeeming their points within this network.

Security and Fraud Protection

The X1 Card ensures peace of mind for customers as it is very secure and has fraud-free features that provide coverage from any unauthorised transactions or misuse. It is one of the Visa Signature cards that are considered positive in terms that it comes along with benefits like auto rental collision damage waiver, travel and emergency assistance, extended warranty protection, and trip cancellation interruption reimbursement. The card also offers a zero-liability policy, which is extra protection for acts of wrongdoing in fraudulent transactions.

Potential Drawbacks and Considerations

Although the X1 Card offers a good deal, it should be noted that this offer has its downsides, which we now need to address ourselves. The main disadvantage is severely limiting redemption options – cardholders are able to receive top value only at X1 financial partner organisations. In terms of flexibility in reward usage, you opt for cashback instead of choice just from the rewards catalogue, and the X1 Card is not the most suitable. Furthermore, the card does not provide a welcome bonus or special APR promotional offers that could be considered as a potential negative by those who expect premium benefits at the inception of a new account.

X1 Card Exploration: Things To Consider

Income Determines Eligibility:

- Description: The X1 Card’s eligibility depends on income, as do other credit cards. Unlike similar cards, the X1 needs bank account verification of income. The credit limit is based on existing and predicted income. If refused, your credit ratings are unchanged, but acceptance causes a hard inquiry that lowers them.

- Insight: Income verification tailors loan limits, reflecting ethical lending.

Immediately Available Rewards:

- Description: The X1 Card’s fast rewards stand out. Earn 2 points for every $1 spent, 3 points on $6,500 after a $1,000 monthly spend, and up to 10 points for $1 spent for 30 days following a referral. Cashback and statement credits are instant. Certain merchants may give periodic boosts to reward shoppers.

- Insight: Instant incentives strengthen the card’s user-friendliness, meeting industry requirements.

Instant Card Use After Approval:

- Description: X1 Card approval allows quick use, an uncommon credit card feature. Transactions can begin before the metal card arrives. Digital wallet use requires a virtual card number; however, the method is unclear.

- Insight: Instant card use meets current needs for speed and ease, improving user experience.

Fee-Friendly Method:

- Description: The X1 Card has no yearly international transactions or late fees. Though regular payments are preferred, late payments have no penalty APR. As of March 2023, the attractive APR range of 15.75% to 28% encourages careful credit utilisation.

- Insight: The X1 Card is a cost-effective choice for people who want to avoid hidden costs.

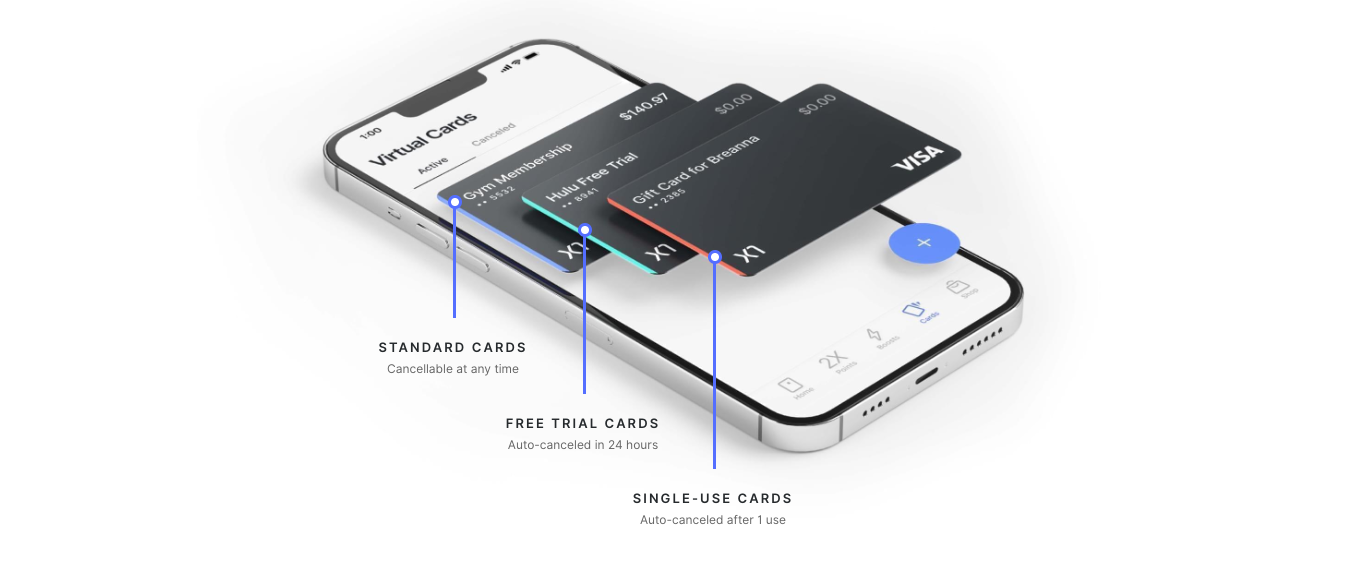

Convenient Efficiency Features:

- Description: The X1 Card simplifies financial management with credit bureau reporting for credit growth, one-time use of virtual credit card numbers for anonymity, and the possibility to add family members’ cards with spending tracking and restrictions.

- Insight: These features go beyond standard credit cards to meet various customer demands and encourage responsible credit.

Please Note: The restrictive limitations governing the redemption of rewards could make those who would desire flexibility on how they utilise their rewards, not mention political sensitivity. The card is best described and pronounced to future customers with no annual fees because it has an unbelievably high yield audit, coupled with a nice attractive look design including many benefits for this specific segment among redemption by X1 partners.

Pros and Cons

| Pros | Cons |

| Generous earnings structure | No welcome bonus or introductory APR offers |

| There is no late fee or foreign transaction fee | Rewards redemption limited to X1 partners |

| Wide range of redemption options with over 50 partners |

Conclusion

The X1 Credit Card creates a distinctive identity in terms of the credit card market as it comes up with a different approach to determining or evaluating one’s level of creditworthiness and handsome rewards. This unique feature of the card is that the income from which you want to improve your score plays a major role rather than solely on credit scores; this makes it an attractive option for those who are looking forward to improving the credit profile they have.

FAQs

How does the X1 Card determine creditworthiness?

Instead of using only current but also future income to determine creditworthiness –X 1 Card, according to the author, may yield results in a higher limit that is nearly five times larger than customary card issuance.

Can I redeem X1 Card rewards for cash back?

No, the X1 Card redemptions are available only through partners like Travel Consultants for the best value. Currently, there is only one way to use the cashback – to take it in the form of a statement credit, and each point’s value for this purpose does not exceed 0.97%.

Is there a welcome bonus or introductory APR offers with the X1 Card?

The X1 Card does not give a welcome bonus nor an introductory rate to APR offers. Of particular interest is its commission-sharing plan with substantial long-term benefits.

What are the additional benefits of the X1 Card?

As a Visa Signature card, the X1 Card comes with auto rental collision damage waiver, travel and emergency assistance, extended warranty protection, and trip cancellation and interruption reimbursement.

Is there a foreign transaction fee with the X1 Card?

No, the X1 Card does not charge a foreign transaction fee and could, therefore, be considered a reliable partner when doing travel abroad without extra costs.