Credova: A Financing Option for Outdoor Enthusiasts

In Short

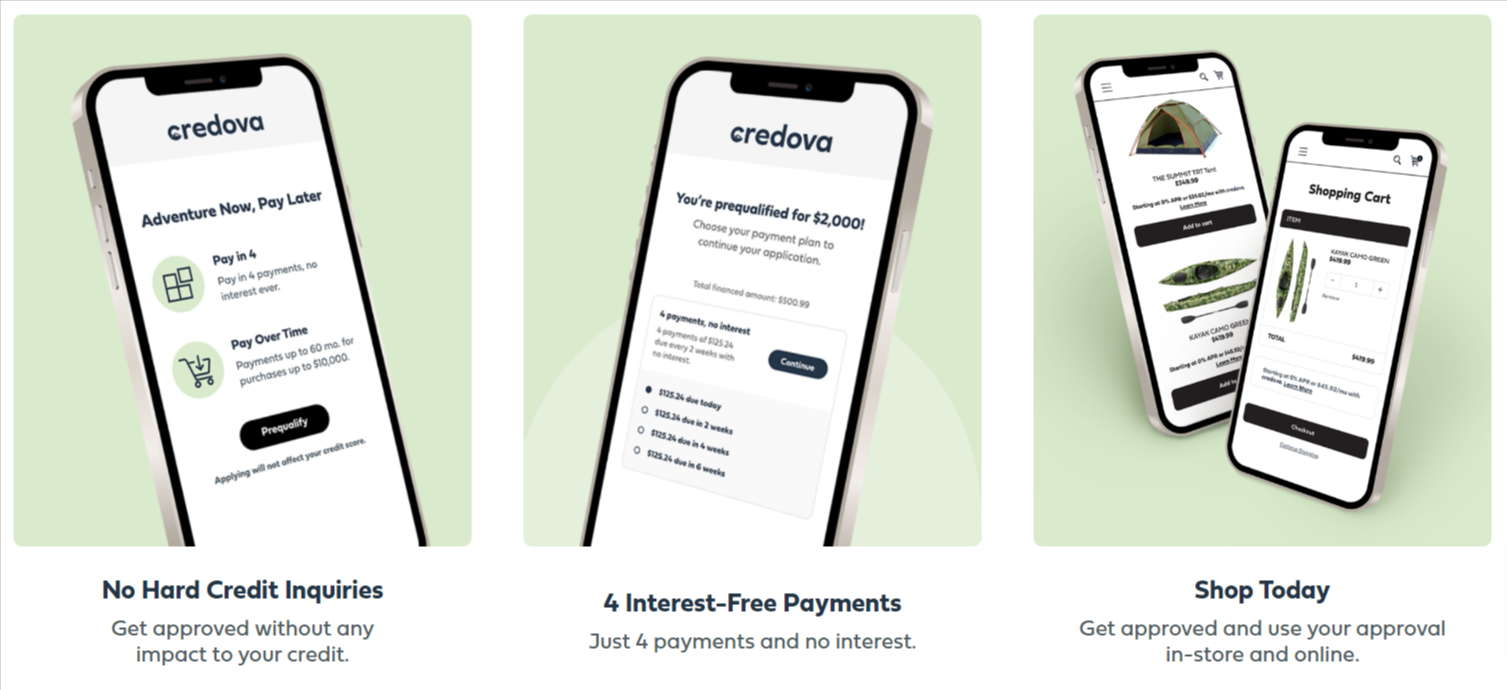

- Credova’s point-of-sale financing lets customers buy now and pay later without interest. The approval process takes seconds and does not affect credit scores.

- Online and in-store retailer platforms use the company’s technology to power customizable BNPL solutions, increasing conversion rates and order values.

- Flex Repay instalment loans are key possibilities. These loans spread payments evenly over 3 or 4 months and have a 0% APR through partner stores.

- Credova helps people finance major purchases safely, and businesses reduce risks with its analytics and machine learning capabilities, enabling scale.

Credova pioneered flexible point-of-sale (POS) financing solutions and quickly became a financial technology leader. Credova, a leading Buy Now, Pay Later (BNPL) service, is revolutionizing consumer and retail commerce with innovative payment options. Credova helps merchants increase conversions and average order values by smoothly integrating POS financing and empowering shoppers to buy now and pay later. Credova provides all-around BNPL commerce benefits with enhanced decisions and predictive analytics.

Key Specifications

| Specification | Details |

| Financing Amount | Up to $10,000 |

| Credit Impact | No Hard Credit Inquiries |

| Payment Structure | Four Interest-Free Payments |

| APR | Starting at Zero APR |

| Outdoor Activities Coverage | Hiking, Camping, Hunting, Fishing, Motorsports, Water Sports |

| Flexibility | In-Store and Online |

| Trustpilot Rating | 4 out of 5, based on 983 reviews |

| Application Process | Partner Retailer Selection, Add Items to Cart, Checkout with Credova, Fill Application, Verify Identity, Approval, Review Terms, Complete Purchase |

| Conditions | Payment Flexibility, Instant Approval Decision, Customizable Spending Limits, Grace Period for Payments, Partnership Expansion |

| Money Disbursement | Point-of-Sale Financing, Not a Lump Sum Loan |

| Products | Buy Now, Pay Later (BNPL) Financing Solution for Partner Retailers |

| Qualification Process | Quick Evaluation, Potential for Instant Approval |

Understanding Credova’s Financing Solutions

At its core, Credova distinguishes itself from traditional lenders by offering customized Installment Payment Plans integrated at checkout. Both online and brick-and-mortar retailers can tap into Credova’s POS financing options to provide their customers with payment flexibility. The company’s flagship products, Flex Repay, allow tailored multi-pay structures with transparent consumer pricing. Credova facilitates instant lending decisions by integrating proprietary decisioning technology into retail environments. This frictionless credit integration infrastructure enables seamless checkout approvals while supporting accounts receivable and remittance processing on the backend.

Benefits of Using Credova for Retailers

For forward-thinking retailers, integrating Credova creates frictionless shopper experiences where flexible finance plans confidently lead customers to complete more purchases. With BNPL options, average order values typically increase as basket sizes grow. Retailers also foster loyalty and unlock revenue through repeat purchases over time using POS financing. Ultimately, Credova allows retailers to meet accelerating consumer demand for personalized payment options without taking on all the risks and complexity of lending programs themselves. The automated BNPL solutions save considerable administrative expenses compared to manually supporting complex instalment plans.

How Credova Works for Consumers?

Credova successfully attracted millions of users on the consumer side by providing instant purchasing power to buy what they want today while paying predictably over time. Thanks to fast digital approvals, qualified shoppers can secure lending decisions in seconds, all within their shopping journeys. Credova approvals do not require hard credit bureau checks, protecting scores. Approved applicants know exactly what limits they qualify for with clearly communicated rates and repayment terms upfront, avoiding surprises. As customers pay down initial balances responsibly, they can build positive credit histories by reporting payments to bureaus.

Credova’s Integration with E-commerce Platforms

From an integration standpoint, Credova provides unified Commerce APIs that facilitate plug-and-play connections across all major e-commerce platforms with minimal development lifts. Robust support for platforms like Shopify, Magento, BigCommerce, and Salesforce Commerce Cloud allows merchants to embed advanced BNPL functionality that scales program growth. Backed by machine learning and AI-enabled decisioning, Credova also equips retailers with performance dashboards highlighting critical metrics for data-driven optimization. Credova alleviates technology burdens for partners to deliver premium experiences in the thriving but complex BNPL domain by adopting a SaaS delivery model.

Reliability of Credova

Credova earns a Trustpilot rating of 4 out of 5 based on nearly 1000 customer reviews. This level of user satisfaction confirms Credova’s general dependability in delivering flexible payment solutions. As an independent benchmark, the Trustpilot score signals users’ trust in Credova’s services.

Steps to Apply for Credova Financing

- Choose a Retailer Accepting Credova

- Add Desired Items to Online Cart

- Select Credova at Checkout

- Complete the Online Financing Application

- Verify Identity if Prompted

- Receive Instant Approval Decision

- Review Provided Terms and Conditions

- Finish Purchase Using Credova

Security and Privacy Features in Credova

Credova operates in sensitive financial services fields and implements institutional-grade security safeguards and privacy protocols when handling consumer data. The company annually validates its rigorous information security controls through independent SOC 2 Type II audits, ensuring banker-level data protection and secure BNPL lending operations. Credova also maintains accredited PCI Level 1 Service Provider status, reflecting the gold standard for protecting cardholder and shopper information across integrated retail finance technology.

Potential Challenges and Solutions with Credova

One valid concern across BNPL involves risks of enabling consumer debt dependence or overspending. However, advanced players like Credova actively employ machine learning algorithms to promote responsible spending limits tailored to individual user data and shopping behaviours. Providing embedded financial literacy resources and insights within the user experience fosters better money management using POS financing judiciously rather than excessively. For retailers dealing with heightened product returns and potential revenue losses, Credova integrates analytical dashboards for better return rate forecasting – allowing partners to derive insights to limit possible abuse where sensible.

Please Note: Credova provides point-of-sale financing, not direct consumer cash advances. Approval decisions depend on individual financial factors. Users must review terms and ensure compliance with state financial product and service regulations.

Pros and Cons of Using Credova

| Pros | Cons |

| Adaptability across outdoor activities | Potential temptation to overspend |

| Enables access to quality gear with payments over time | It can foster dependency on financing instead of saving up |

| Credit-friendly shopping without hard credit checks | Limited to specific partner retailers |

| Integration with retailers online and in-store |

Conclusion

In closing, as the BNPL market expands exponentially, Credova continues leading through innovation. It empowers retailers to meet accelerating consumer demand for POS financing that protects margins and boosts lifetime value. Meanwhile, mainstream shoppers have embraced Credova’s POS payment plans, which increase purchasing power through predictable instalments and improve buying flexibility. With advanced API-driven and integrated commerce solutions, Credova enables partners to unlock new revenue growth with specialized BNPL commerce capabilities that scale.

FAQs

Does Credova advance cash?

Credova provides POS financing for partner retailer purchases. It does not give users cash advances.

Can Credova auto-approve everyone?

The application process is fast and convenient, but financial assessments determine approvals, thus rapid approval is not assured.

Credova’s services—legal?

Credova operates lawfully under consumer finance product frameworks as a regulated financial services company.

What makes Credova a suitable lender?

Compare terms, fees, and interest rates to your financial goals to determine a good fit. You must also read user evaluations and recognise real-world advantages and cons.

What should I do before agreeing to Credova’s terms?

Carefully review all terms and conditions while also ensuring Credova operates legally within your state. Know your consumer rights and rescission window before finalizing any financing contract.