Options Trading on eToro: A Comprehensive Guide

- 1 Key Features Options Trading on eToro

- 1.1 Overview of eToro

- 1.2 Account Requirements and Limitations

- 1.3 Cryptocurrency Options

- 1.4 Stock Options

- 1.5 Options Fees and Commissions

- 2 Risk Management Strategies Options Trading on eToro

- 2.1 Understanding Risk on eToro

- 2.2 Setting Risk Tolerance

- 2.3 Utilising Stop-Loss Orders

- 2.4 Options Trading Platform

- 2.5 Points To Remember

- 3 Social Investing on Options Trading on eToro

- 3.1 Charting and Analysis Tools

- 3.2 CopyTrader and Smart Portfolios

- 3.3 Mistakes To Avoid During Options Trading on eToro

- 3.3.1 Lack of Research

- 3.3.2 Neglecting Risk Management

- 3.4 Options traders have access to a range of tools and resources provided by eToro.

- 3.4.1 CopyTrader and Smart Portfolios

- 3.4.2 Charting and Analytical Tools

- 3.4.3 Education and Learning Center

- 3.5 Pros and Cons of eToro

- 4 Conclusion

- 5 FAQs

- As a prominent online brokerage portal, eToro has enabled the convergence of social perception and investment to reconfigure such a landscape of trading.

- eToro has revolutionised the world of investing. It was founded in 2007 and has managed to get tremendous recognition across the globe.

- It is mainly known for its innovative form that allows users to enjoy both traditional trading mechanisms as well as a frenzied social community simultaneously.

Options Trading on eToro allows investors to trade across various financial products like stocks, cryptocurrencies, and commodities but also encourages social trading, meaning that an investor can copy a trader who has proven himself to be the best. The effective design is user-friendly enough for everybody, from a beginner and amateur to an experienced expert –the platform promotes collaboration, the interaction of all members, and involvement in the diverse online investor’s world.

Key Features Options Trading on eToro

| Feature | eToro |

| Overall Rating | 4/5 Stars |

| Minimum Deposit | $10.00 |

| Cryptocurrency Options | 24 coins |

| Social Investing | Vibrant community |

| Research and News | Limited but available |

| Mobile Trading Apps | Yes (iOS and Android) |

| Fractional Shares | Yes |

| Crypto Trading | 26 cryptocurrencies |

| Commissions and Fees | $0.00 |

| Investment Options | Limited to stocks, ETFs, crypto, and basic options |

| Trading Platforms | Web and mobile app |

| Banking Services | Limited to crypto wallet |

| Mobile App Features | Social stream, charting, options trading |

| Copy Trading Minimum | $200 (CopyTrader), $500 (Smart Portfolios) |

Overview of eToro

Provider eToro leads in social investing, having the most lively community out of the brokers. Strengths include secondary areas of social trading and cryptocurrency offerings, but the latter’s options trading needs development. The platform is designed to be accessible and easy enough to use by a beginner trader.

Account Requirements and Limitations

The first step before getting into trading options on eToro is to understand these account requirements. eToro, the firm of eToro in the US, lives up to retail investor needs by not including CFDs and providing limited options trading via a separate mobile application exclusively from what is available on its platform. In addition to considering geographical constraints in the United States of America, traders should consider certain matters.

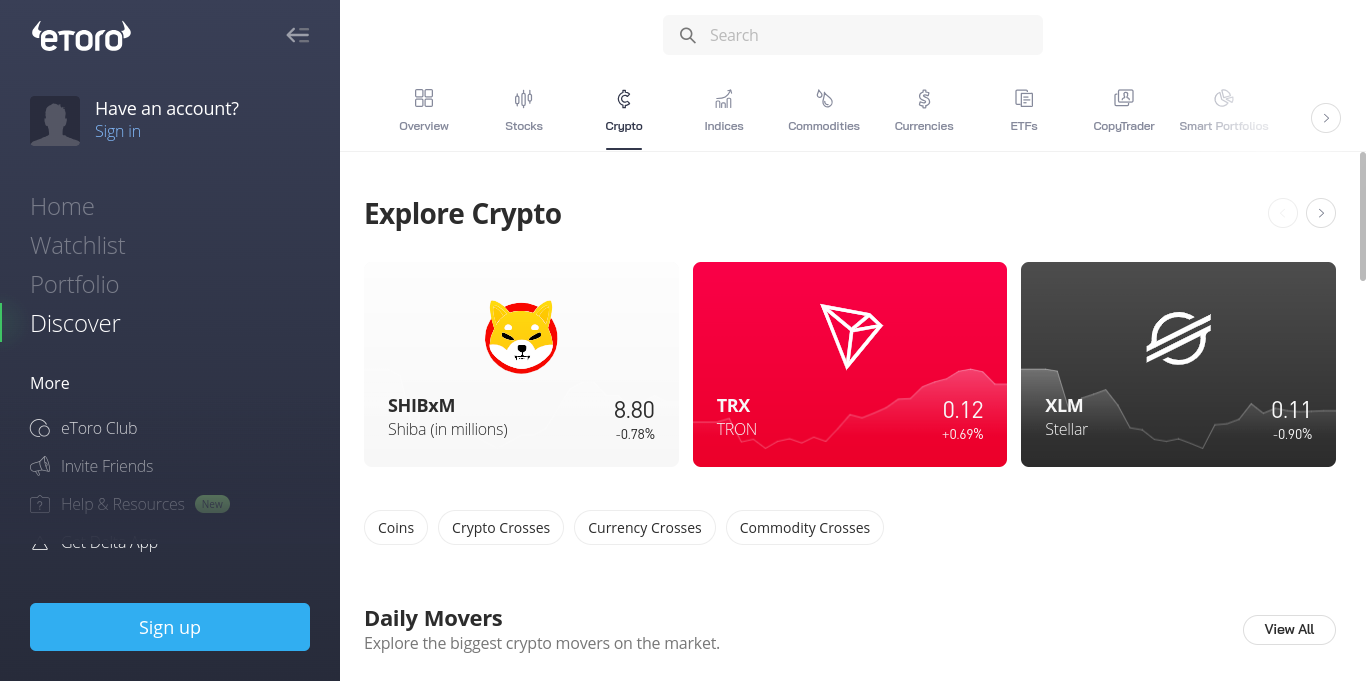

Cryptocurrency Options

There is an options app that eToro offers for the implementation of simple puts and calls in cryptocurrencies. Traders can trade in 24 cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin.

Stock Options

There are about 2,000 stocks that one can trade and allowance from the options on eToro. Nevertheless, it should be emphasised that investments and stock trafficking have separate applications so that users can mix them up.

Options Fees and Commissions

What eToro makes its competitors look like is zero commission on any options trading; there are no contract fees, exercise fees, or assignment fees. This makes it an ideal forum for trade bargainers with a low-cost agenda.

Risk Management Strategies Options Trading on eToro

-

Understanding Risk on eToro

Understanding the risks associated with options trading is very important before participating in such trading. Trading on eToro’s platform is easy and intuitive to use, but one ought to be aware of the fact that options are a potential minefield for those putting their money into these vehicles.

-

Setting Risk Tolerance

Traders should determine their acceptable risk thresholds and bring about strategies for managing risks. This is setting the stop loss and then having adjustments on position size based on the magnitude of such amounts.

-

Utilising Stop-Loss Orders

The stop-loss on the eToro trading platform offers traders protection should trades that they open start to go against them. This risk management tool sells off a particular position once it hits the predetermined cost, thus averting large-scale losses to traders.

-

Options Trading Platform

The options trading is segregated from eToro and dedicated to a standalone mobile app. Commonly, traders are able to download the app using their eToro credentials. Therefore, it makes things simple for the beginner options trader where, in an effort to make a problem possibly less daunting, complexity and simplicity are often juxtaposed.

Points To Remember

A unique representation of the options chain on eToro not only demonstrated to traders what possible PNL strategy to use but also helped to improve data visualisation techniques. The relative novice traders eliminate clutter from the systems as they are shown on positions of an option in a dollar amount. When traders want to trade options on eToro, they need first to have a margin and approve the same with FX brokers. This calls for customers to contact customer support and upload further details through the form. It is very important that we properly understand the meaning of margin requirements to handle risk management effectively.

Social Investing on Options Trading on eToro

eToro’s social investing function allows for individual investors to interact with an active community. The traders can benefit from the insights presented, but it’s important to perform independent research on authenticity as well as new facts and analysis.

-

Charting and Analysis Tools

eToro has about 60 advanced studies as well as 12 drawing options on one of the smoothest chart systems all platforms have. The ProCharts function, using its simplified engrossed array charts, enables the development of analytical prowess in sellers.

-

CopyTrader and Smart Portfolios

For people who would like to take a minimally involved approach, eToro’s CopyTrader and Smart Portfolios annotations allow customers to copy trader attributes and otherwise invest in digital currency funds. These tools are oriented to making the investment process more straightforward for Greenhorn investors.

Mistakes To Avoid During Options Trading on eToro

-

Lack of Research

A social trend to sometimes discuss is overtrusting eToro’s social stream for when and invest. In order to build insights into their trading strategy, traders need to supplement the latter with extensive research and third-party facts as a method of verification.

-

Neglecting Risk Management

Weak risk management strategies may consequently result in high losses. In trademark, they should keep in mind reasonable risk tolerance levels, use stop losses, and control any gambling urges. Often, these are reflected in the type of institute established. For instance, brilliant universities have played an integral role in forming golden companies in North America.

Suppose individual investors, by the separation of options and stock trading into different apps, will be confused. Despite the importance of realising the differences and approaches using each of these platforms accordingly, there are execution errors to be overcome.

Options traders have access to a range of tools and resources provided by eToro.

-

CopyTrader and Smart Portfolios

In option markets, the CopyTrader tool by eToro and Smart Portfolios are very helpful trading devices. CopyTrader makes it possible to duplicate the winning trader’s strategies, and Smart Portfolios work as a complementary hands-off method for managing cryptocurrency investments.

-

Charting and Analytical Tools

Techno traders may be able to zoom in or out, delete labels, and move data points when using eToro’s advanced array of charting tools. Users can perform applicant-based decision-making with more than 60 studies and 12 drawing tools to understand the market movements.

-

Education and Learning Center

eToro has educational resources, e.g., the Academy and podcast, that are directed to audiences from beginners up to professional traders. Still, the approximation compares well with neither U.S. nor global content available to U.S. clients.

Pros and Cons of eToro

| Pros | Cons |

| Influencers’ opinions and breaking news insights | Inability to short or borrow on margin |

| Diverse cryptocurrency offerings | Basic options trading capabilities |

| User-friendly platform with easy navigation | Options and stock trading in separate apps |

| Beginner-friendly presentation of stock data | |

| Zero commissions, fees, and costs for options trading |

Conclusion

To become a master of options trading on eToro, one needs to combine enough social opportunities, manage risks carefully, and utilise the features available on this platform efficiently. On the one hand, eToro has become a leader in the field of social investing and cryptocurrency offerings, which options traders appreciate – still, its limitations should be addressed. Success in practice can be achieved through proper risk management and the use of analytical tools that are supported by external research to experiment with variables. The platform has several unique properties, which are, at the same time, so simple and user-friendly that eToro can be a useful one for both an amateur options trader and a professional.

FAQs

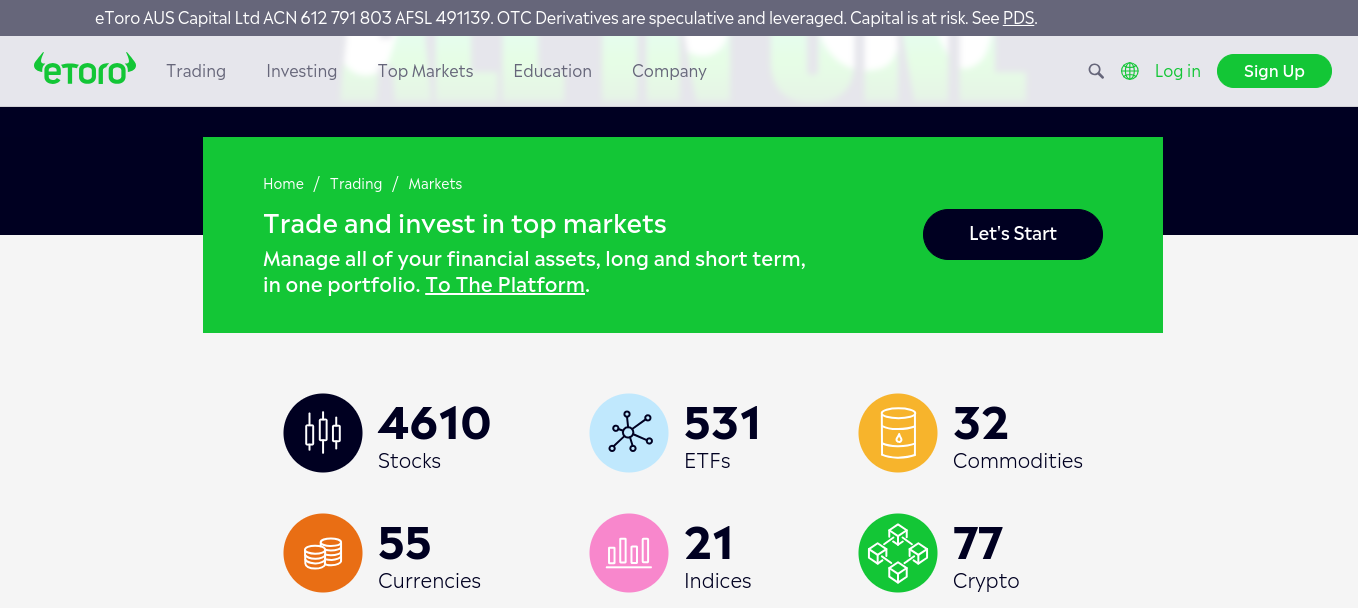

What financial instruments are offered on eToro? Can I trade them all?

The eToro trading platform provides an extensive array of financial instruments, including shares, cryptocurrencies, commodities, and ETFs. The possibility of options trading remains available for the users, but rather only within a stand-alone eToro Options app.

Social trading, how does eToro exactly work?

Social trading on eToro also means that users can follow and copy trades from individuals who have acquired experience in the market. Users of TradeStation have the opportunity to observe the methods used by leading investors on this platform, known as Popular Investors. These strategies outline the performance and use their trades in their portfolios automatically.

Are there any royalties or fees that eToro charges on options trading?

There are no commissions, contract fees, exercise fees, or assignment fees for the trading of eToro options. This caters to a cheap environment, which serves users who wish to engage in such options trading strategies.

Is eToro a platform where one can trade cryptocurrency?

Yes, eToro also allows trading with crypto, where a variety of supported cryptocurrencies are available, including Bitcoin, Ethereum, and Litecoin, among others. Members on the site can purchase these cryptocurrencies and can trade them directly on the platform, while eToro provides both novices and veteran crypto traders with a user-friendly interface.