Sears Credit Card: The Rise and Fall of an American Retail Icon

- 1 Sears Through the Years

- 1.1 The Collapse of a Retail Giant

- 1.2 The Sears Credit Card: Rewards and Financing

- 1.3 Home Services Financing and Rewards

- 1.4 Requirements Required

- 1.5 How to Apply for a New Credit Card from Sears

- 1.6 Access Searscard.com in Just Three Easy Steps

- 1.7 Have You Forgotten Your Password?

- 1.8 Who Should Consider the Sears Card?

- 1.9 Alternatives to the Sears Card

- 1.10 Applying for and Managing Your Sears Card

- 1.11 The Future of Sears

- 2 The Final Word

- 3 FAQs

- 4 What caused Sears to lose its position as a major retailer?

In Shorts:

- You may get perks and special financing with the Sears Credit Card when you use it for significant home improvements.

- One way that cardholders may save money when shopping is by taking advantage of special sales and discounts.

- Paperless statements, accessible online account management, and customer support are always available.

- With no yearly charge, it’s an excellent choice for regular buyers at Sears.

- You can save a tonne of money with 5% off some purchases and cash-back benefits.

Sears was once the largest retailer; founded in 1886 as a mail-order catalogue selling watches and jewellery, it grew over the next century into a coast-to-coast department store empire with over 3,500 locations. However, the company has struggled to adapt to a changing retail landscape and filed for bankruptcy in 2018. Today, only a handful of stores remain open. Yet the Sears brand lives on through its website, credit cards, and home services division.

Sears Through the Years

Sears’s beginnings trace back to 1886 as a mail-order watch business set up by Richard Sears. Over the next several decades, Sears, Roebuck, and Co. expanded its catalogue to offer everything from clothing to entire house kits. By the middle of the 20th century, Sears had opened hundreds of retail stores across America and became the country’s largest retailer and employer. However, the late 20th century brought new challenges as discount stores like Walmart and Target ate into Sears’ market share. Sears acquired Kmart in 2005, but the combined company continued to struggle.

The Collapse of a Retail Giant

In its heyday, Sears was considered an innovator in retail and a gateway to the middle class for much of America. It was the place to shop for appliances, tools, and household goods for decades. However, the emergence of new competition left Sears struggling to keep pace. After filing for bankruptcy in 2018, Sears only managed to keep around 400 stores open. Then, in 2019, further closures whittled the company down to less than 200 locations under the Sears and Kmart banners. Currently, only a few dozen Sears and Kmart stores are still operating.

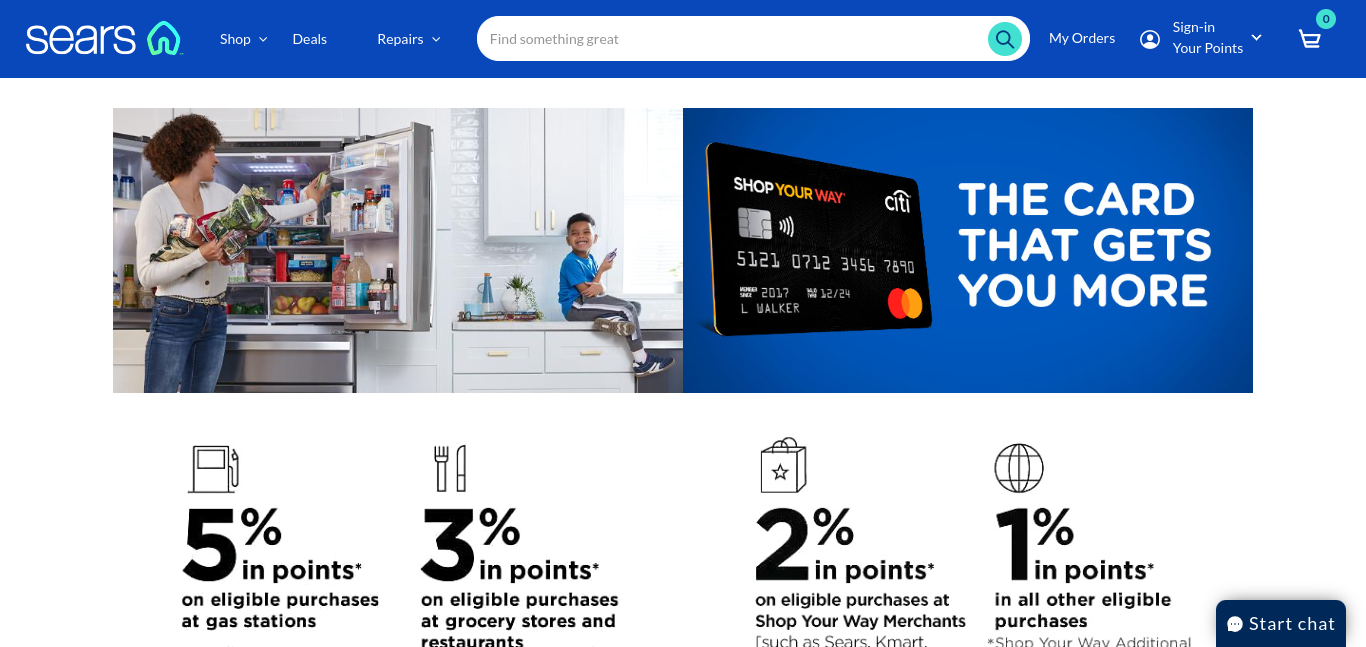

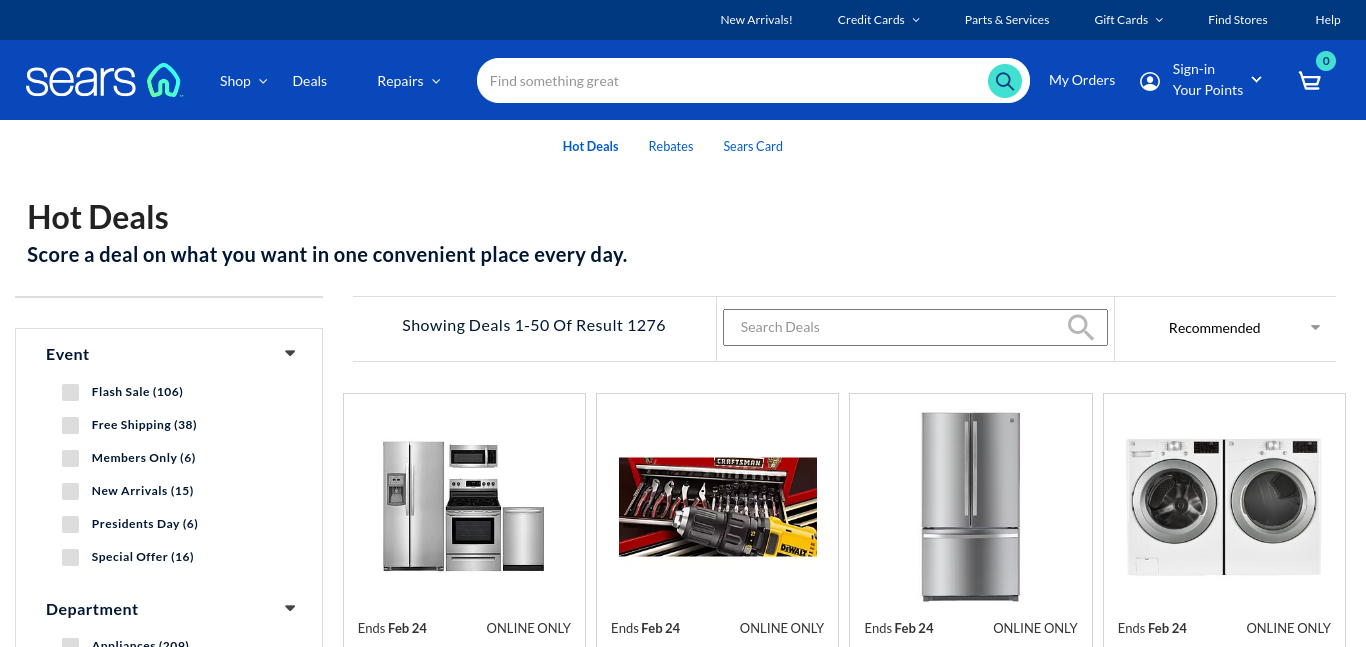

The Sears Credit Card: Rewards and Financing

Despite its shrinking store base, Sears continues to operate its credit card business. The Sears Credit Card and Sears Mastercard offer cardholders special rewards and financing deals on significant purchases. Customers can save 5% on some items or pay no interest for 12 months or longer on more prominent tickets above $299. Cardholders earn cash back rewards points on everyday purchases, which can be redeemed at Sears locations. There are also exclusive cardholder savings events and seasonal promotions. The cards have no annual fee.

Home Services Financing and Rewards

Another area Sears maintains is its Home Services division, which provides installation, repairs, and home improvement projects. Cardholders can tap into special offers with the Sears Card, like 18 months of no-interest financing on new heating/AC systems, roofing, windows, and more. Rewards can be earned on home upgrades with additional savings on installation labour. This allows homeowners to purchase materials at Sears and coordinate turnkey installation using professional Sears Home Services technicians.

Requirements Required

Before you do anything else, ensure you have the following to register your card and log into your Searscard.com account.

- A mobile device, laptop, computer, or other smart device with internet connectivity.

- Your preferred web browser, Opera, Mozilla Firefox, Google Chrome, etc.

- The login address for Sears cards.

- Your current Searscard.com account username and password.

How to Apply for a New Credit Card from Sears

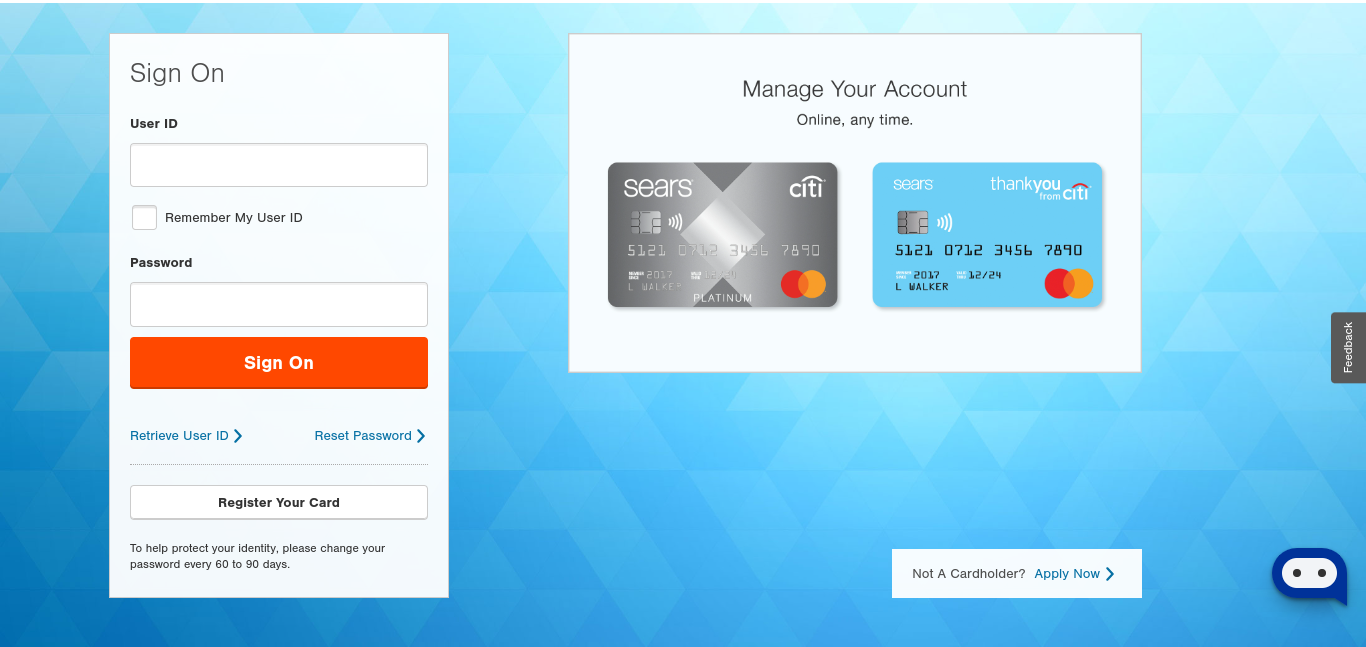

But hold on, you must first register your Sears credit card before you can log in. Only new Seas cardholders are eligible for this area. You can omit this step if you have previously registered your card.

- Launch your browser, then enter www.searscard.com.

- Go to the Sears credit card registration page and choose the card type that you want.

- There’s a second button labelled “Register Your Card” underneath the “Sign On” button. After you click that, enter your credit card information and continue.

- Input the last four digits of your Social Security number (SSN), credit card number, security code, and name as it appears on the card. Then just be sure.

- Input all personal data required to finish the procedure and register your card.

- Select your Searscard.com account’s User ID and Password. Remember that if you want your credit card to remain secure, you must never disclose this information to anybody.

- Please choose your security question and respond to it. If you lose access, you must never forget your response to this.

- After selecting the service type you want, click Next.

- Your Sears credit card is now formally registered on the website after carefully completing these procedures. From now on, you can control your card and obtain a range of data and support about your Sears credit card.

Access Searscard.com in Just Three Easy Steps

After your card has been officially registered, you may log into your account and utilize the online services that are accessible. You may proceed by simply following these three steps!

- Once more, launch your preferred web browser and navigate to searscard.com to access the login page.

- On the Login box, enter your valid User ID and Password.

- Your account will open after clicking the “Sign On” button. Proceed with whatever has to be done.

Have You Forgotten Your Password?

Sometimes, you can’t recall our login information, and regrettably, you didn’t write it down somewhere secure. Be kind to yourself—it happens to the best of us! Thankfully, there’s usually a solution to every problem, and in this instance, we can still save the day by trying to get your details back.

Have faith that these actions will lead you to your destination:

- The official Sears card website is the same URL you use to log in, so type it into your browser.

- Two options are available underneath the Login form: Get User ID and Password Reset.

- If you cannot recall your username, click Retrieve User ID; if you have forgotten your password, select Reset Password—basic things.

- Whichever option you select, a screen will load, and you’ll be required to input personal data, including your credit card number, the name on the card, the security code, and the last four digits of your Social Security number.

- Press Verify.

- Just adhere to the directions that appear below. If you are successful, you ought to be able to get your login information back and begin accessing your account as usual.

Who Should Consider the Sears Card?

The Sears Card or Sears Mastercard can make the most sense for existing Sears shoppers planning major home upgrades or appliance purchases. As Sears continues to shrink its retail footprint, the card’s top perks centre on its Home Services financing deals and cardholder discounts on big-ticket items. For those already loyal to Sears for home and garden equipment like washers and dryers, tools, and outdoor power equipment, the 5% discounts and special financing can add up to significant savings. Before applying, consumers should check their credit score, which is in at least the mid-500s, to qualify.

Alternatives to the Sears Card

Of course, most major retailers now offer branded credit cards with similar financing deals and rewards. Home improvement stores like Lowe’s and Home Depot provide special financing and discounts to their cardholders. Amazon offers 5% cash back to Amazon Prime members. General cash-back credit cards can also provide substantial rewards on household purchases without tying users to a particular retailer. Comparison shopping for credit card terms is essential before committing to one card.

Applying for and Managing Your Sears Card

Customers can apply on the Sears website or in-store to receive a Sears Card or Sears Mastercard. An approval decision is made after the applicant undergoes a soft credit inquiry. The cards carry deferred interest promotions and high ongoing APRs, so having a balance can lead to expensive finance charges. Cardholders can manage their Sears credit card accounts online and access special offers and savings. The cards allow contactless payments, online bill pay, paperless statements, and 24/7 customer service. Users are encouraged to pay their balance on time each month.

The Future of Sears

Sears will likely never return to its former glory days as a dominant American retailer. However, the company has managed to stave off complete liquidation of its assets. The firm continues attempting to leverage the power of its well-known Kenmore and Craftsman brands. If Sears can reinvent itself as primarily an online and home services provider, supported by its credit card business, the iconic name may survive. But for shoppers today, the case for using a Sears card rests heavily on planned significant appliances and home upgrades rather than everyday use.

The Final Word

For good cause, business journalists and financial experts have been known to call Sears a “zombie retailer.” Once a titan of American commerce, Sears has collapsed to a few dilapidated storefronts and sold off some of the trademarks it created from the ground up, like Kenmore appliances and DieHard batteries. However, the Sears website still sells such and many other well-known brands. Suppose a customer is considering upgrading their house with new appliances or other significant improvements. In that case, they should at least compare the financing alternatives offered by Sears to those of its numerous rivals.

FAQs

What caused Sears to lose its position as a major retailer?

Due to its difficulties adjusting to shifting consumer preferences and heightened competition, Sears eventually declared bankruptcy in 2018.

How many Kmart and Sears locations are open right now?

The number of Sears and Kmart locations that are still open now is quite low compared to its heyday.

What benefits and ways to finance are available with the Sears Credit Card?

Benefits offered to cardholders include cash back incentives on regular purchases, 5% discounts, and interest-free financing for more than 12 months on purchases above $299.

Does the Sears Credit Card work for purchases made in-store?

No, you may use the card to make online purchases at the Sears website as well.

What unique financing options does the Home Services division offer?

For a period of eighteen months, Sears Cardholders can finance a variety of home improvement projects at no interest.