MoneyGram Online Services

- 1 Key Specifications of MoneyGram Online

- 2 How to Use MoneyGram Online: A Step-by-Step Guide

- 2.1 Setting Up & Finding a Location

- 2.2 Speed of Transactions

- 2.3 Receiving Money

- 2.4 Cost and Fees

- 2.5 Business Solutions

- 3 Advantages of Using MoneyGram Online

- 4 Security Measures in MoneyGram Online Transactions

- 4.1 Regulation and Compliance

- 4.2 Encryption

- 4.3 Fraud Prevention

- 4.4 Transaction Tracking

- 4.5 Physical Pick-Up Security

- 4.6 Fees Associated with MoneyGram Online

- 4.7 Comparison with Traditional Money Transfer Methods

- 4.8 App Features

- 4.9 Currency Exchange Rates

- 4.10 Tips for a Smooth and Efficient Experience

- 5 Pros and Cons of MoneyGram

- 6 Conclusion

- 7 FAQs

In Short:

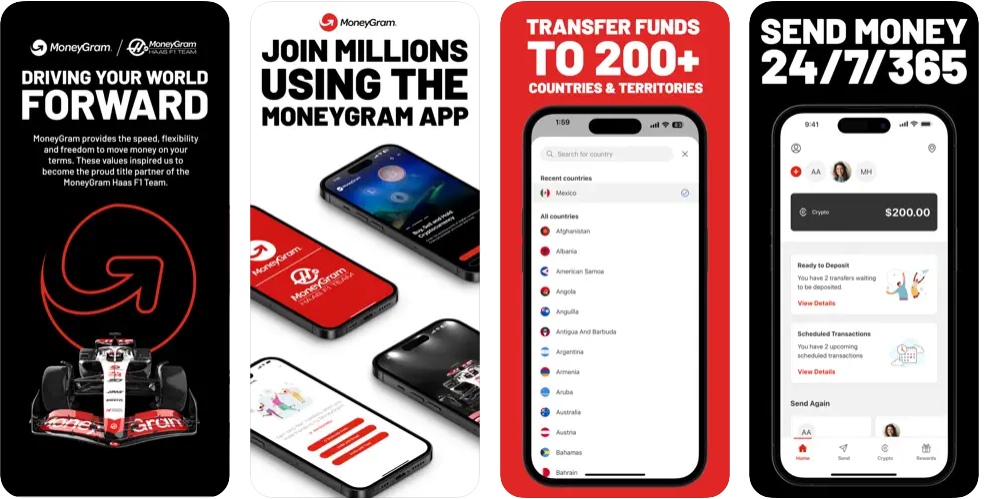

- Global Presence: MoneyGram operates in 200+ countries, providing customers access to 350,000+ locations abroad for easy transactions.

- Fast and Flexible: The system provides various payout options, which are bank transfers, cash, and mobile wallets. Same-day transfers are, most of the time, very fast in many cases.

- Security Assurance: The Security of MoneyGram is of utmost importance; it complies with international regulations, has SSL encryption, and has a dedicated fraud prevention team.

- User-Friendly Mobile App: The MoneyGram app is a full-fledged financial assistant that provides all the features in one place and makes the user experience smooth and convenient.

MoneyGram has an extensive network of more than 350,000 cash pick-up locations and services in over 200 countries around the world which places it as a leading player in the money transfer business and a major player in the financial sector. In this thorough review of MoneyGram’s online services, we will look at all of the features, benefits, security measures, costs, and other aspects. We’ll provide you with data to help you choose between us, a company providing reputable international transactions, and you, an individual dealing with foreign payments.

Key Specifications of MoneyGram Online

| Specification | Details |

| Global Reach | 200+ countries |

| Agent Locations | 350,000+ |

| Payout Options | Bank transfer, cash, mobile wallet, etc. |

| Transaction Speed | Minutes to 4 business days |

| Exchange Rate Margin | Up to 5.05% |

| Transfer Limit | Up to £10,000 every 30 days |

| Mobile App Features | Comprehensive and user-friendly |

| Security Measures | SSL encryption, compliance with regulations |

How to Use MoneyGram Online: A Step-by-Step Guide

-

Setting Up & Finding a Location

To start using MoneyGram, locate the closest location by using the mobile app or conducting an internet search. Finding an agent is usually easy because there are hundreds of them in the world. Online account creation is a simple process that takes a few minutes.

-

Speed of Transactions

MoneyGram has a reputation for processing transactions quickly, particularly with their “minutes service.” The precise timing, however, may differ depending on a number of variables, including the country of destination, regional laws, and the delivery method (bank account, cash pickup, or mobile credit). Usually, there is a maximum delay of four business days.

-

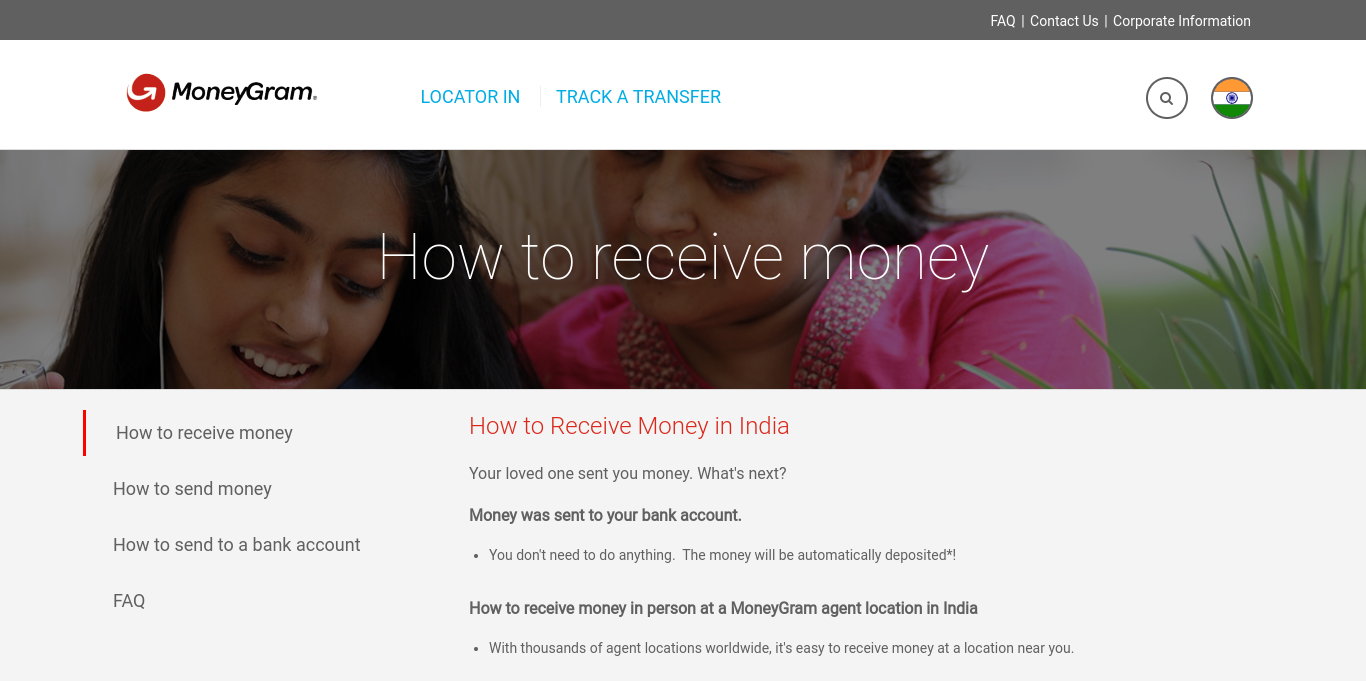

Receiving Money

When a recipient has a reference number and a legitimate ID, receiving money is simple. Either via direct deposit or cash collection, the procedure is designed to be easy to use and quick.

-

Cost and Fees

MoneyGram charges costs that are clear and based on the kind of payment, destination, and size of the transfer. Although the site has reasonable transfer costs, consumers should be aware that the exchange rate margin might reach 5.05%.

-

Business Solutions

MoneyGram is an attractive choice for businesses because of its wide network and availability in several currencies. Additionally, the platform gives users the opportunity to lock in a rate, which gives firms stability in volatile markets.

Advantages of Using MoneyGram Online

With 200 countries under its belt and 50 currencies available, MoneyGram is among the market’s most globally accessible suppliers. MoneyGram has a physical presence that might be comforting for customers who prefer in-person transactions, with over 350,000 agent locations and kiosks. MoneyGram gives consumers freedom by offering a variety of payout choices, such as cash, bank transfer, and mobile wallet. Fast and effective transactions are guaranteed by the platform’s same-day transfers to bank accounts in the majority of nations. Users will find it straightforward to utilise MoneyGram’s user-friendly platform and app, which clearly displays charges and information.

Security Measures in MoneyGram Online Transactions

-

Regulation and Compliance

MoneyGram carefully abides by KYC standards and anti-money laundering rules, in addition to complying with international legislation governing money transfers. The FCA fully regulates MoneyGram in the UK.

-

Encryption

To guarantee the security and privacy of any data transmitted between users and the platform, MoneyGram uses SSL technology.

-

Fraud Prevention

A specialised fraud prevention team on the platform keeps a close eye on transactions to spot any questionable activity.

-

Transaction Tracking

The MoneyGram system is made more transparent by allowing each transaction to be tracked with a special reference number.

-

Physical Pick-Up Security

In order to guarantee that only the designated recipient may access the funds, recipients are required to present proper identification when they receive money.

Fees Associated with MoneyGram Online

MoneyGram charges transaction fees that are clearly based on the amount of the transfer, ranging from £5 for transfers between £1 and £49 to 2% for transfers over £500. The currency and transfer method exchange rates offered by MoneyGram differ. Users need to be aware that the exchange rate margin can rise to 5.05%.

Comparison with Traditional Money Transfer Methods

The innovative and efficient services of online MoneyGram replace conventional money transfer techniques. The App is a great choice for those looking for ease and accessibility as it has fast transfers, global outreach, and a user-friendly interface.

App Features

The MoneyGram mobile app combines all of the platform’s features in a smooth manner, which makes it a complete financial assistant. Users can start transactions easily, follow transfer progress, join the MoneyGram Plus loyalty program, and send money to preferred companies. The app offers a user-friendly experience, combining simplicity and completeness

Currency Exchange Rates

Identifying MoneyGram Online MoneyGram currency exchange rates vary from currency to currency and the mode of transfer. Users need to be aware of this. The exchange rate margin can influence the total expense of a transaction by as much as 5.05%. This is to be considered when comparing MoneyGram to other service providers.

Tips for a Smooth and Efficient Experience

- Plan: Take the transfer amount, destination, and payout type into account when estimating costs and delivery times.

- Compare Rates: Examine other suppliers’ exchange rates in addition to MoneyGram’s to obtain the best deal possible.

- Use the App: For a simple and easy transaction, make use of MoneyGram’s mobile app features.

- Be Aware of Limits: MoneyGram has a £10,000 monthly cap. Therefore, be aware of the transfer restrictions, particularly if you are working with huge amounts.

Pros and Cons of MoneyGram

| Pros | Cons |

| Global Leader | Potential higher costs |

| Extensive Physical Network | Transfer limits of £10,000 every 30 days |

| Diverse Payout Options | Mixed customer support reviews |

| Fast Transfers | |

| User-Friendly Interface |

Conclusion

With more than 350,000 agent locations, MoneyGram Online Services, a global financial powerhouse today, provides money transfers in more than 200 countries. With a comprehensive mobile app and an intuitive platform, the service provides convenience and accessibility. They have to use quick and flexible payout options while keeping an eye out for higher fees and exchange rate margins. MoneyGram places a high priority on security, global regulations, SSL encryption, and a strong anti-fraud mechanism. The platform is a good option for individuals and enterprises with a range of international transaction needs due to its broad worldwide coverage, quick transactions, and easy-to-use interface. Customers should be aware of transfer limitations and the possibility of paying more than with other money transfer services. To sum up, MoneyGram is a trustworthy and practical international money transfer provider.

FAQs

Can I cancel a MoneyGram transfer?

Yes, MoneyGram allows you to cancel a transfer. However, the possibility of doing so depends on the status of the transfer. If the money has not reached the recipient yet, then you can request a cancellation by contacting MoneyGram’s customer support.

How much time it takes to send money with MoneyGram?

Transfer times may differ, from several minutes to up to 4 business days. Factors that affect the time are the amount to be transferred, selected payment method, destination, and currencies involved.

Does MoneyGram take credit cards?

Yes, MoneyGram allows credit cards as a payment method for sending money. Nevertheless, users should be mindful that transaction fees using credit cards are higher than other payment methods.

What is the maximum that I can transfer with MoneyGram?

Yes, MoneyGram has a transfer limit of £10,000 every 30 days. Users should take note of this limit, particularly when transacting large amounts or if they transact frequently.

Which languages does MoneyGram support?

MoneyGram, the global money-transfer leader, offers support in over 40 languages to serve its multinational customer base.